BLOG

John Paulson and George Soros Amasses More Gold!

During the second quarter of this year two of the most notable billionaires, Paulson and Soros amassed large quantities of gold. Over the past few years we have increasingly seen more and more of the affluent dive into gold.

In this particular case former treasury secretary, John Paulson, increased his holdings of SPDR Gold Trust by 26%. This represents a much larger clearer vote of confidence when you consider that of the $21 Billion hedge fund run by Paulson has 44% of its assets tied up in gold bullion. This is a big statement coming from our former US Treasury Secretary.

Additionally, noted billionaire George Soros doubled his holdings in gold. The Soros Fund Management LLC raised its stake to 884,400 shares. Ironically, spokesmen for both financial mammoths declined to comment earlier this week on their recent acquisitions. As much as I dislike George Soros, he is a brilliant man and when he invests it is extremely important to see where he goes.

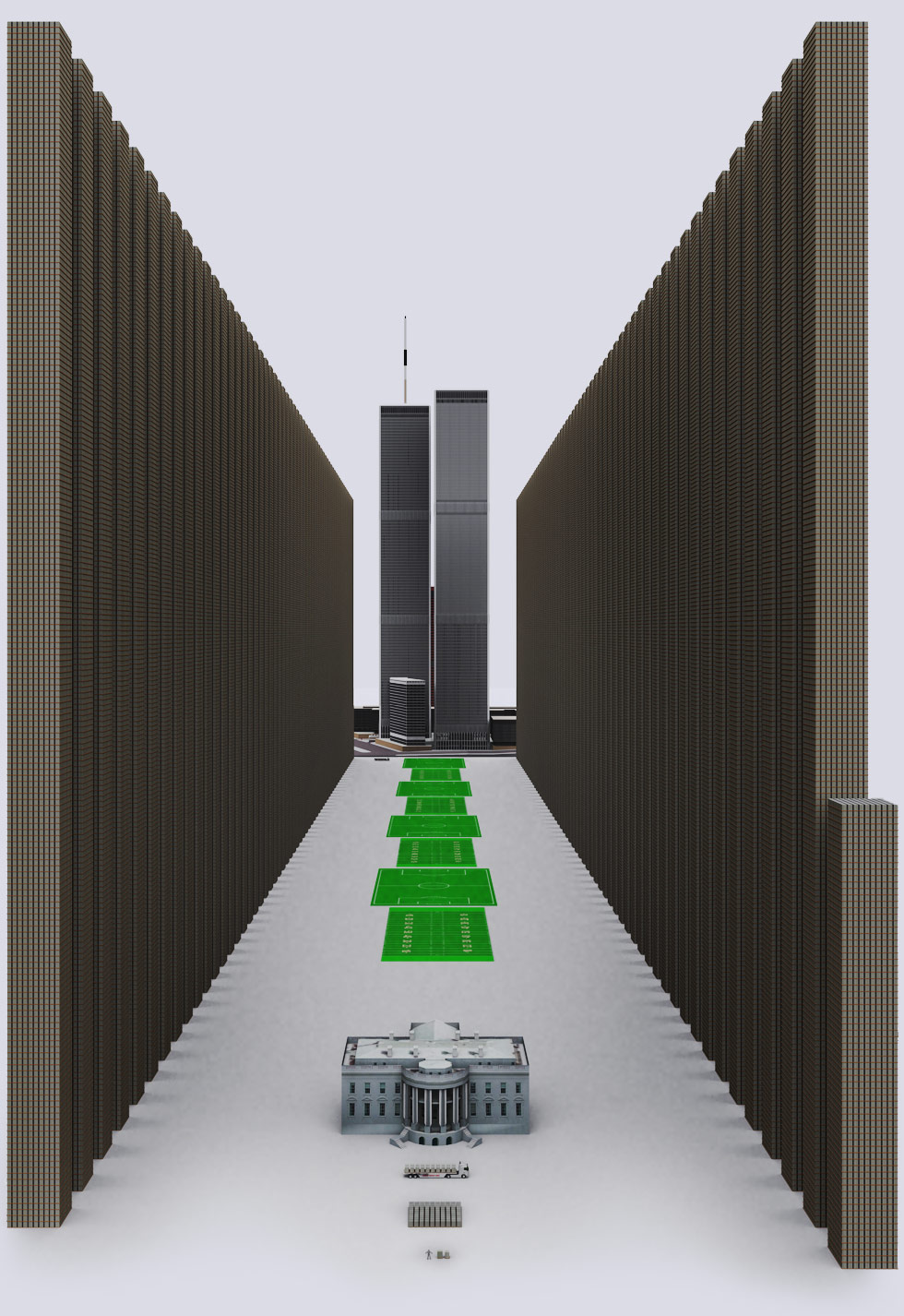

The Best Picture of How Large the Derivative Market Is!

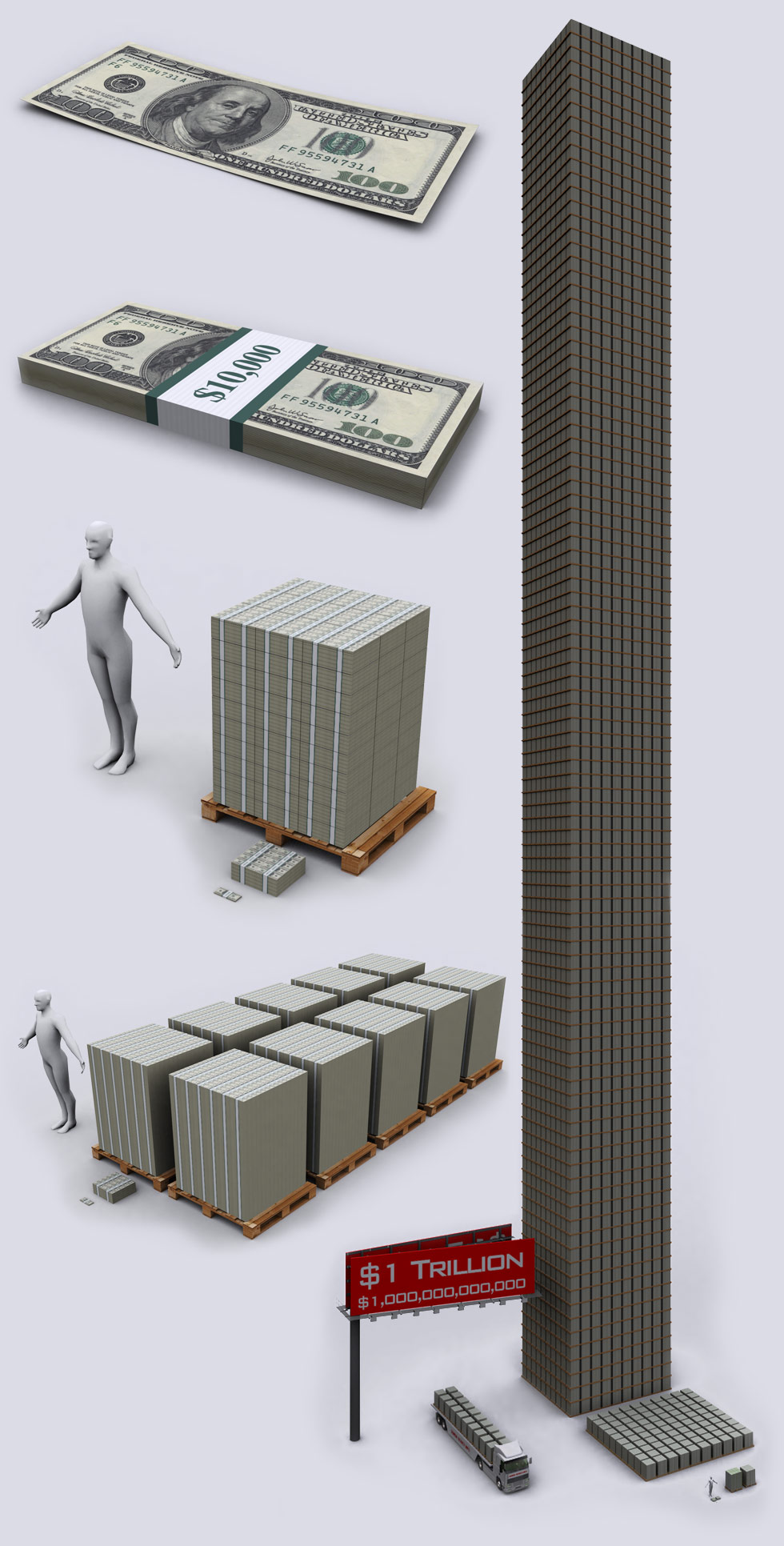

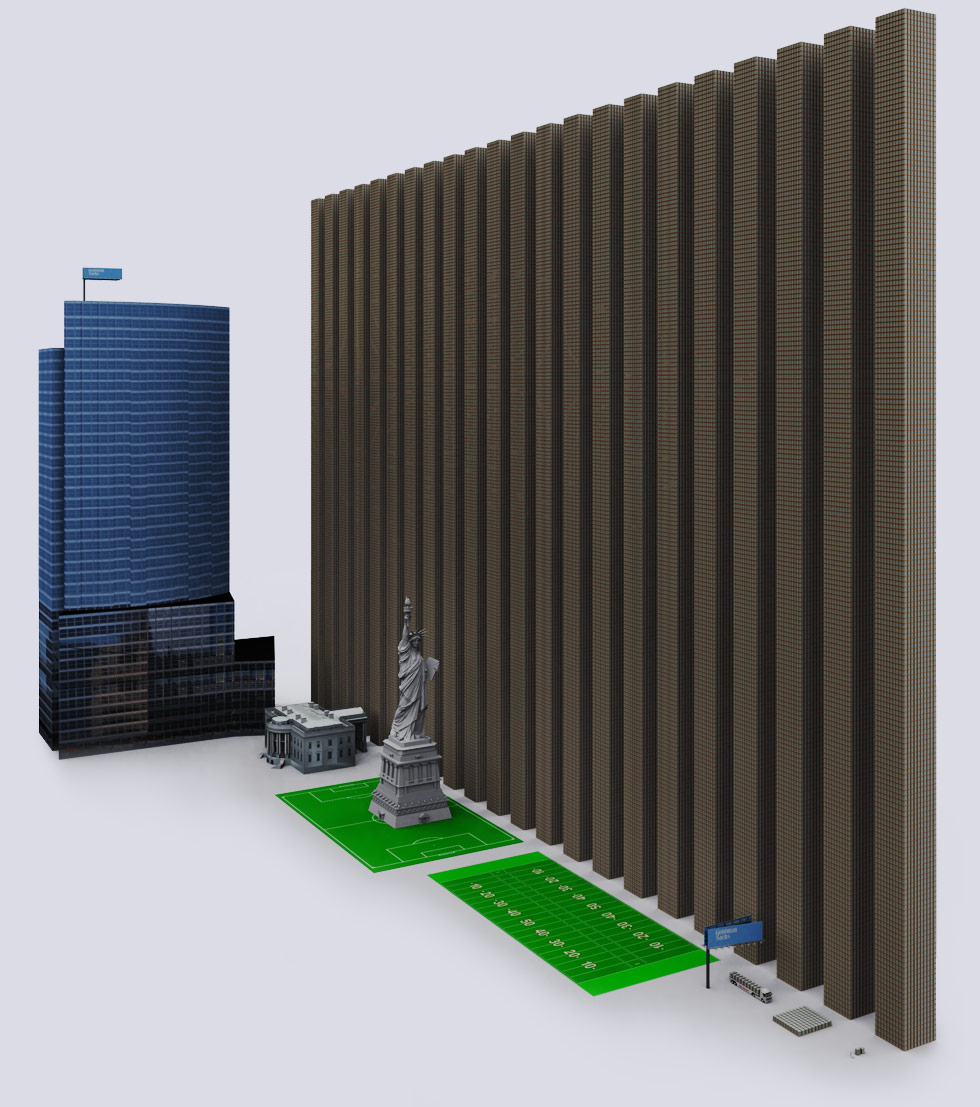

| 1 Trillion Dollars |

| $1,000,000,000,000 – When they throw around the word “Trillion” like it is nothing, this is the reality of $1 trillion dollars. The square of pallets to the right is $10 billion dollars. 100x that and you have the tower of $1 trillion that is 465 feet tall (142 meters). |

Bank of New York Mellon |

| BNY has a derivative exposure of $1.375 Trillion dollars. Considered a too big to fail (TBTF) bank. It is currently facing (among others) lawsuits fraud and contract breach suits by a Los Angeles pension fund and New York pension funds, where BNY Mellon allegedly overcharged the funds on many millions of dollars and concealed it. |

State Street Financial |

| State Street has a derivative exposure of $1.390 Trillion dollars. Too big to fail (TBTF) bank. It has been charged by California Attorney General (among other) lawsuits for massive fraud on California’s CalPERS and CalSTRS pension funds – similar to BNY (above). |

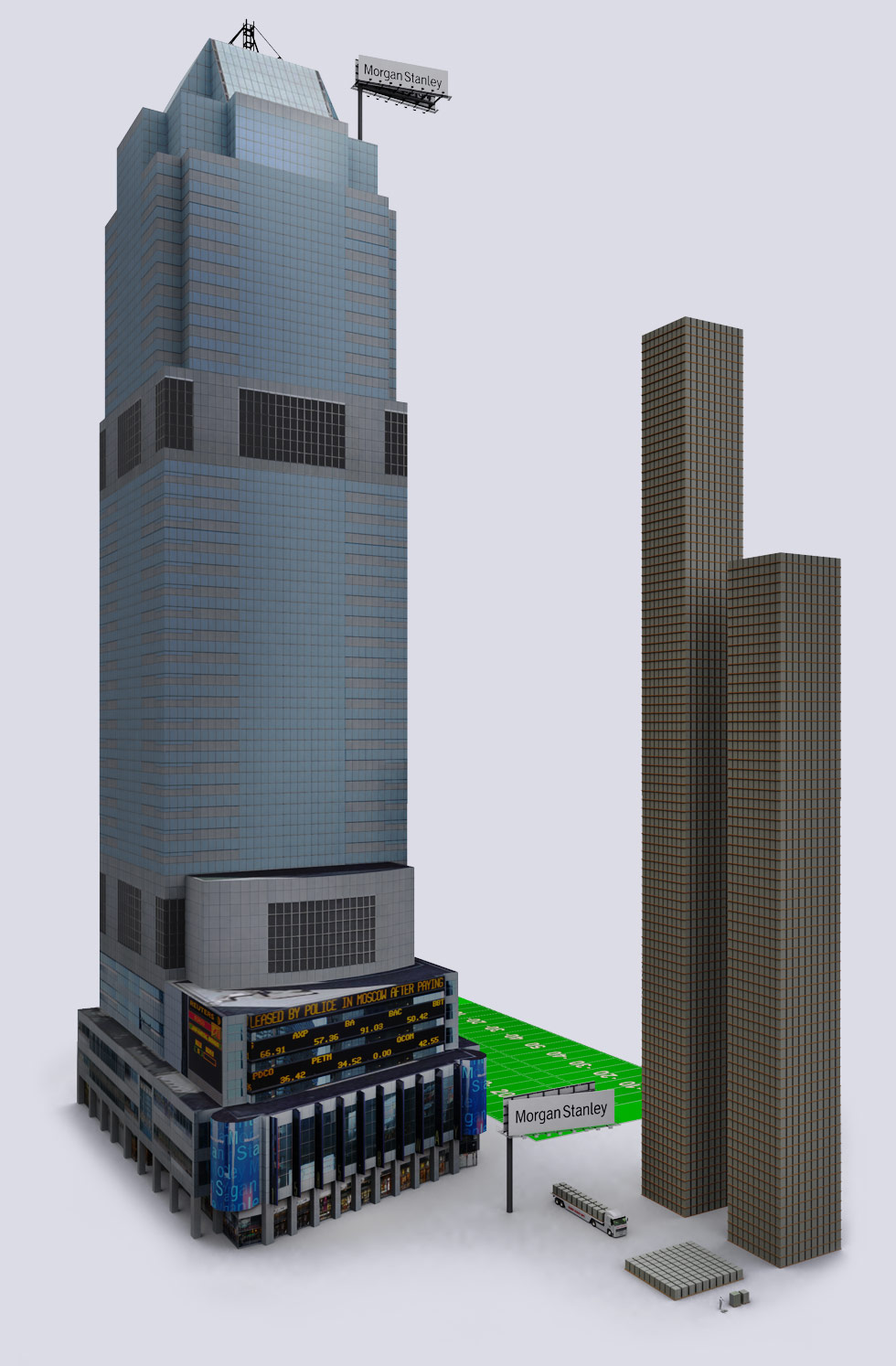

Morgan Stanley |

| Morgan Stanley has a derivative exposure of $1.722 Trilion dollars. Its a too big to fail (TBTF) bank. It recently settled a lawsuit for over-paying its employees while accepting the tax payer funded bailout. Vice Chairman of Morgan Stanley had a license plate that said “2BG2FAIL” on his Porsche Cayenne Turbo. All this while $250 million of bailout money ended up in the hands of Waterfall TALF Opportunity, run by the Morgan Stanley’s owners’ wives– Marry a banker for a $250M tax-payer cash injection. The bank also got a SECRET $2.041 Trillion bailout from the Federal Reserve during the crisis, beyond the tax payer bailout. |

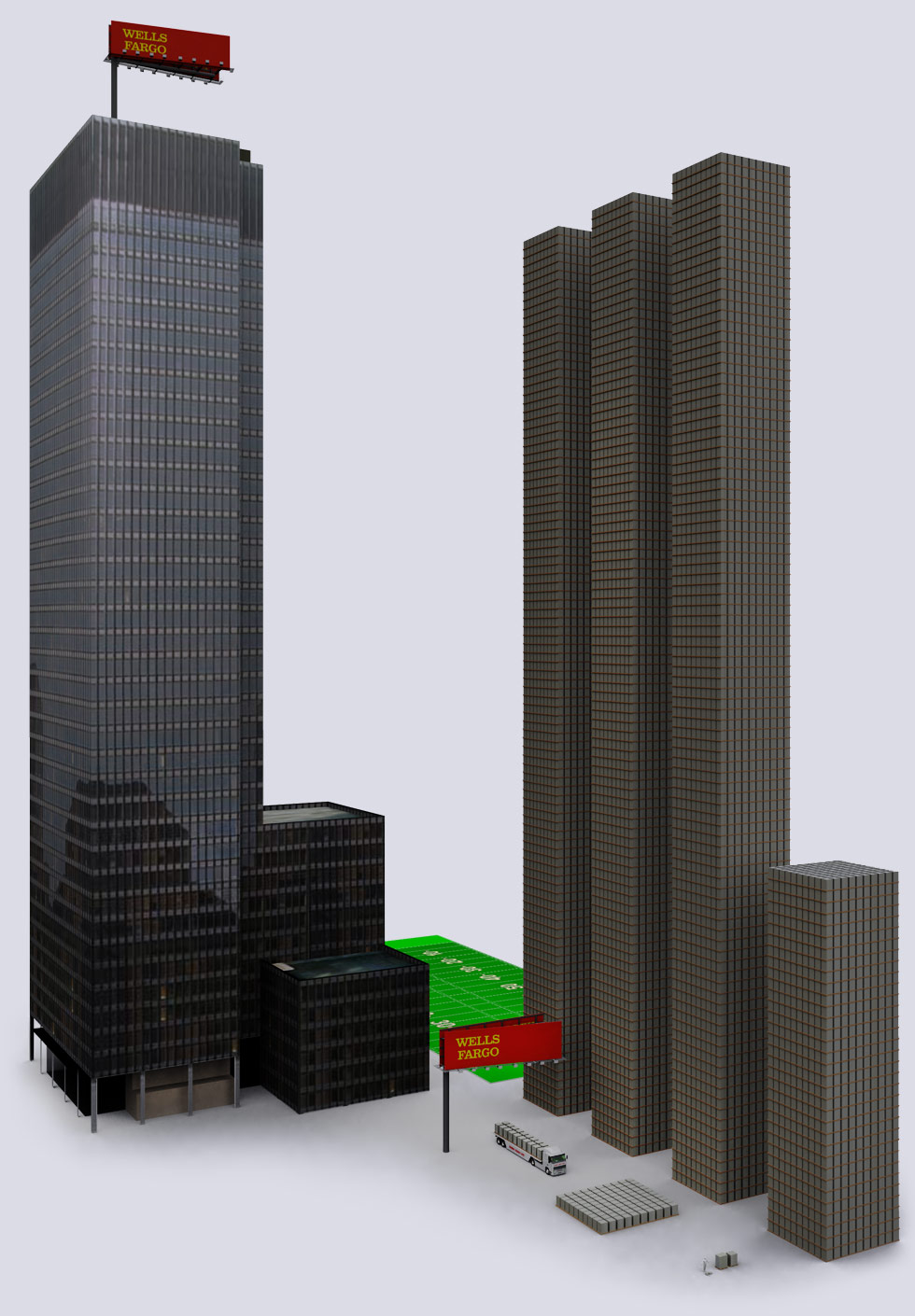

Wells Fargo |

| Wells Fargo has a derivative exposure of $3.332 Trillion dollars. Its a too big to fail (TBTF) bank. WF has been charged for its role in allegedly pursuing illegal foreclosures and deceptive loan servicing. Wells Fargo was just slapped with a $85 million fine by Federal Reserve for putting good credit borrowers into bad-credit rating (high rate) loans. In March 2019, Wachovia (owned by Wells Fargo) paid $110 million fine for allowing transactions connected to drug smuggling and a $50 million fine for failing to monitor cash used to ship 22 tons of cocaine. It also failed to monitor $378.4 billion (that’s $378400 millions dollars) worth of transactions to Mexican “casas de cambio” (think WesternUnion, anonymous cash transfer) usually linked to drug cartels. Beyond that, WF lets its’ VIP employees live in foreclosed mansions. WF knows how to cash your legit check, then claim “fraud” and close your account. WF also re-orders your transactions to create more overdraft fees. Wells Fargo’s Wachovia also got a SECRET $159 billion bailoutfrom the Federal Reserve.Wells Fargo paid NO taxes in 2008-2010 and had a tax rate of NEGATIVE 1.4% while making $49 billion in profit during the same time. |

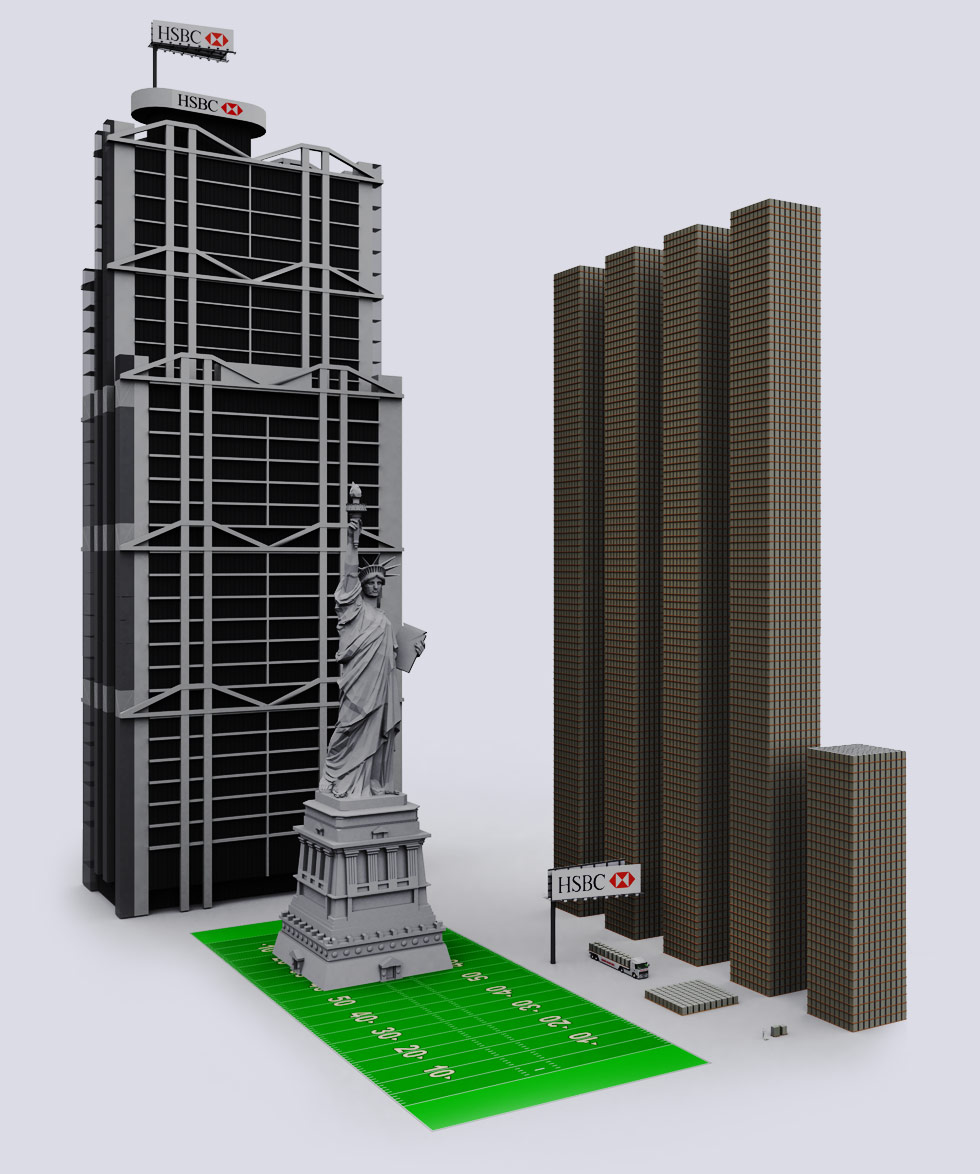

HSBC |

| HSBC has a derivative exposure of $4.321 Trilion dollars. HSBC is a Hong Kong based bank and its original name is The Hongkong and Shanghai Banking Corporation Limited.You will find HSBC working a lot with JP Morgan Chase. Both HSBC and JP Morgan Chase have strong interest in gold & precious metals. HSBC and JP Morgan Chase are often involved together in financial scandals. Lately HSBC has been sued for allegedly funneling more than $8.9 billion to the largest ponzi-scheme in history – Bernie Maddof’s investment business. HSBC (along w/ JP Morgan Chase) has been sued for alleged conspiracy suppressing the price of silver and gold, partially through precious metal DERIVATIVES and making billions of dollars on it. State of Hawaii is suing HSBC (and other banks) for deceptive credit card lending practices. DZ Bank in Germany is suing HSBC (and JP Morgan) for deceptive (lying) practices when selling home-loan-backed securities. HSBC is also under investigation for laundering billions of dollars. |

Goldman Sachs |

| Goldman Sachs has a derivative exposure of $44.192 Trillion dollars. The $1 Trillion pillars towers are double-stacked @ 930 feet (248 m). The White House is standing next to the Statue of Liberty.Goldman Sachs has advantage over other banks because it has awesome connections in US Government. A lot of former Goldman employees hold high-level US Government positions (chart).Mitt Romney’s top donor is Goldman Sachs, and one of Obama’s best donors. Ex-CEO of Goldman Sachs, Hank Paulson became the Secretary of Treasury under Bush and during the 2008 financial crisis authored the TARP bill demanding $700 billion bail-out. In UK, Goldman Sachs escaped £10 million bill on a failed tax avoidance scheme with help of good connections. The bank is the largest player in the food commodities market, earned $955m from food speculation in 2009” – That’s your $$$. Goldman Sachs employees are arming themselves with guns in case there is a populist uprising against the bank. Goldman Sachs calls their investors “muppets“. and use clients to make money for themselves, disregarding the clients. The bank was fined $22 million for sharing valuable nonpublic information with top clients (Think insider trading with best clients). Goldman Sachs was part-owner America’s leading website for prostitution ads until the ownership stake was exposed. Goldman Sachs helped Greece conceal its debt with secret loans, while simultaneously taking advantage of Greece. Goldman Sachs got a $814 billion SECRET bailout from the Federal Reserve during the 2008 crisis. Goldman Sachs got $10 billion of the 2008 TARP bailout, and in the same year paid $10.9 billion in employee compensation and “benefits”, while paying a tax rate of 1%. That means an average of $327,000 to each Goldman Sach’s employee. |

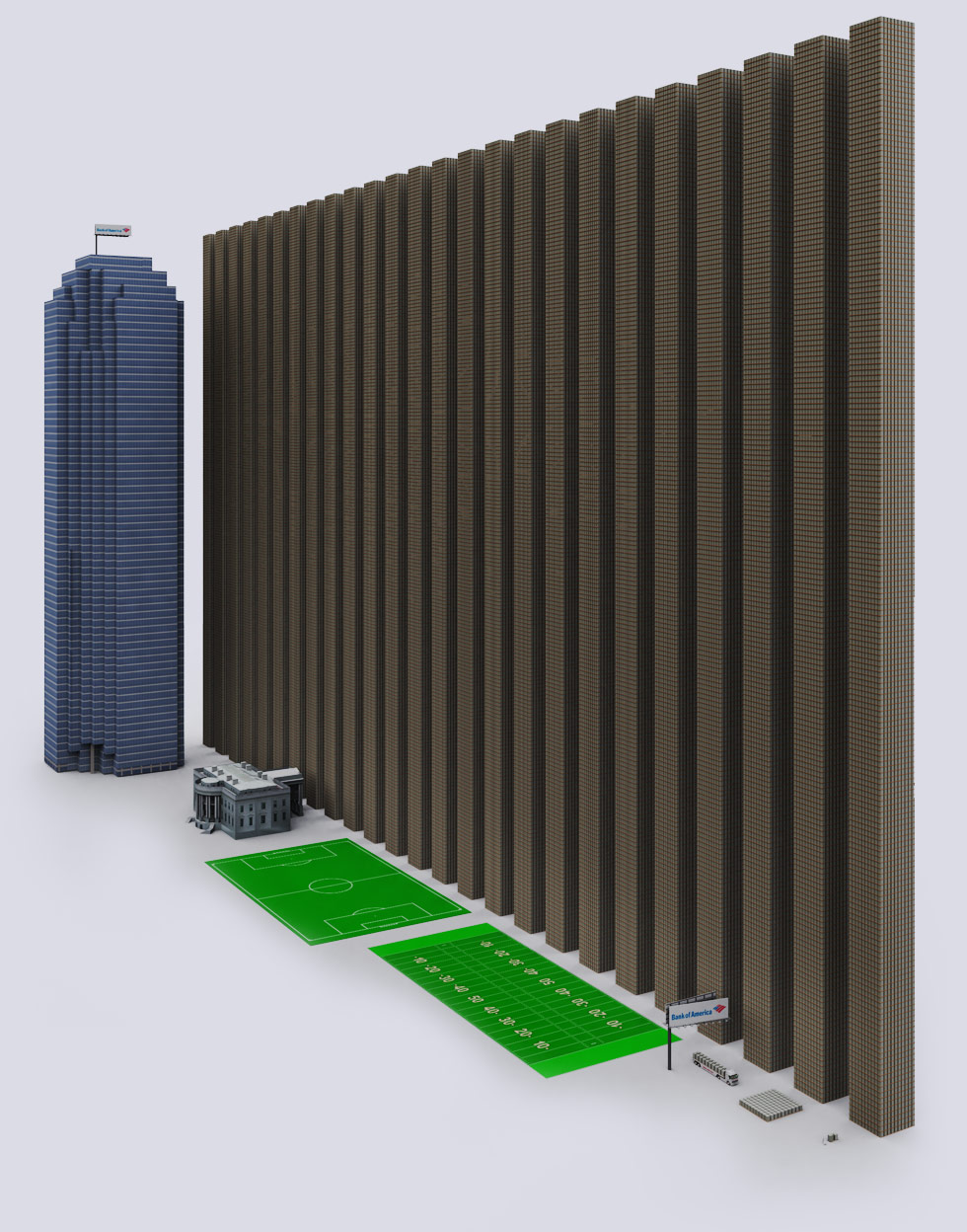

Bank of America |

| Bank of America has a derivative exposure of $50.135 Trillion dollars.BofA is sticking the tax-payers with a MASSIVE bill, by moving derivatives to accounts insured by the federal government @ total of $53.7 trillion as of 06/2011. During 2011-12 BofA has been in need of cash, so Warren Buffett gave BofA $5 billion. Same year BofA sold its stake in China Construction Bank to raise $1.8 billion in cash.Bank of America paid $22 million to settle charges of improperly foreclosing on active-duty troops BofA recruited 3 cyber attack firms to attack WikiLeaks. but the Anonymous hacker group hacked the security firms first. BofA was sued for $31 billion in home-loan losses in 2011, the bank is involved in many lawsuits, too many to document. BofA also received a SECRET $1.344 trillion dollar bailout from the Federal Reserve. |

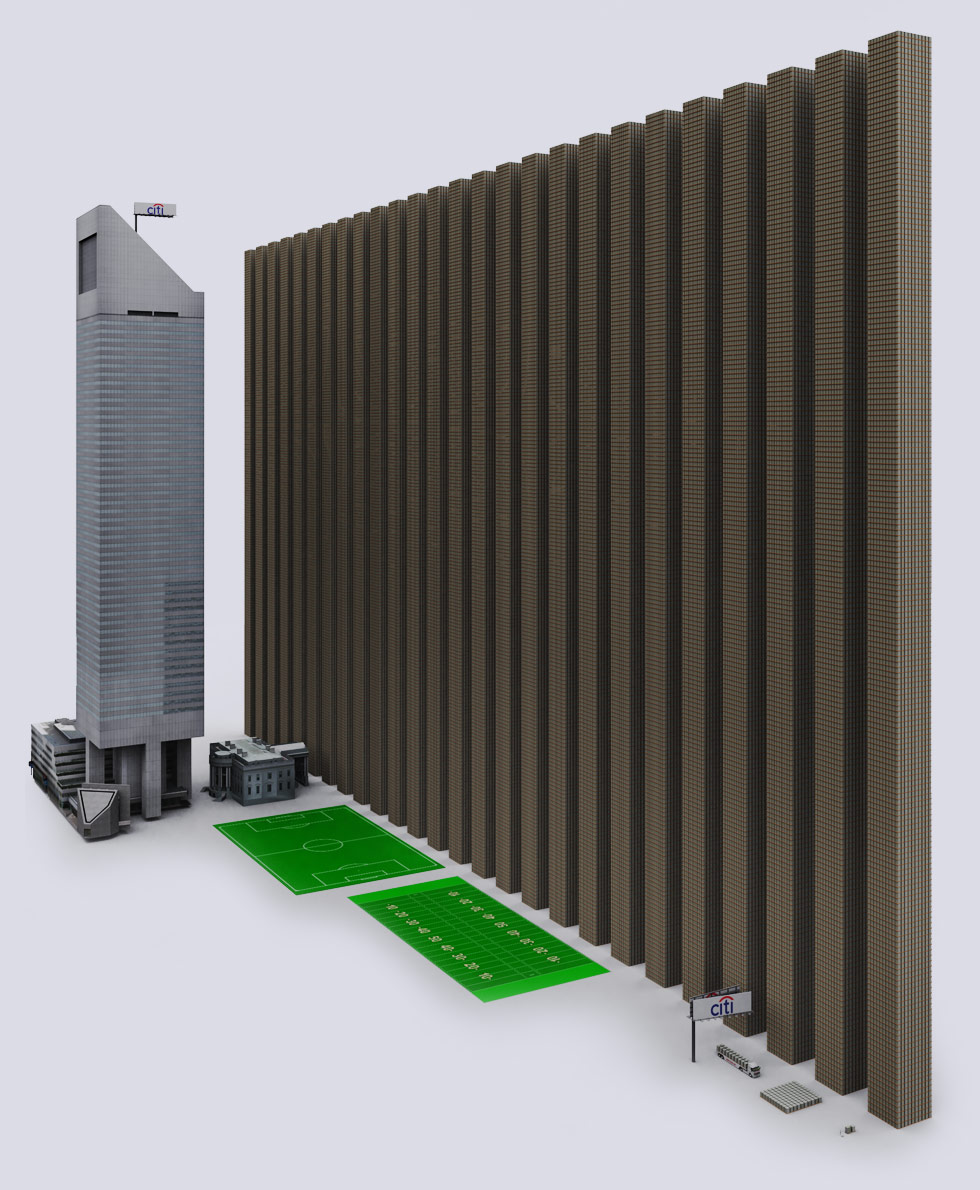

Citibank |

| Citibank has a derivative exposure of $52.102 Trillion dollars. The $1 Trillion dollar towers are double-stacked @ 930 feet (248 m).Citibank customers have been arrested for trying to close their accounts, while in in Indonesia a man was interrogated to death in Citibank’s special “questioning room”. In 2011 Citibank paid a fine of $285 million for selling home-loan backed bonds to investors, while betting they would lose value (think derivatives/insurance). The man in charge of the unit at Citibank became Obama’s Chief of Staff. 2 weeks before getting hired by Obama he got $900,000 from Citibank for great performance. This was after Citigroup took out $45 billion in bailout money. Citibank knowingly passed over bad loansto the Federal Housing Administration to insure.Citigroup also received a SECRET $2.513 trillion dollar bailout from the Federal Reserve. |

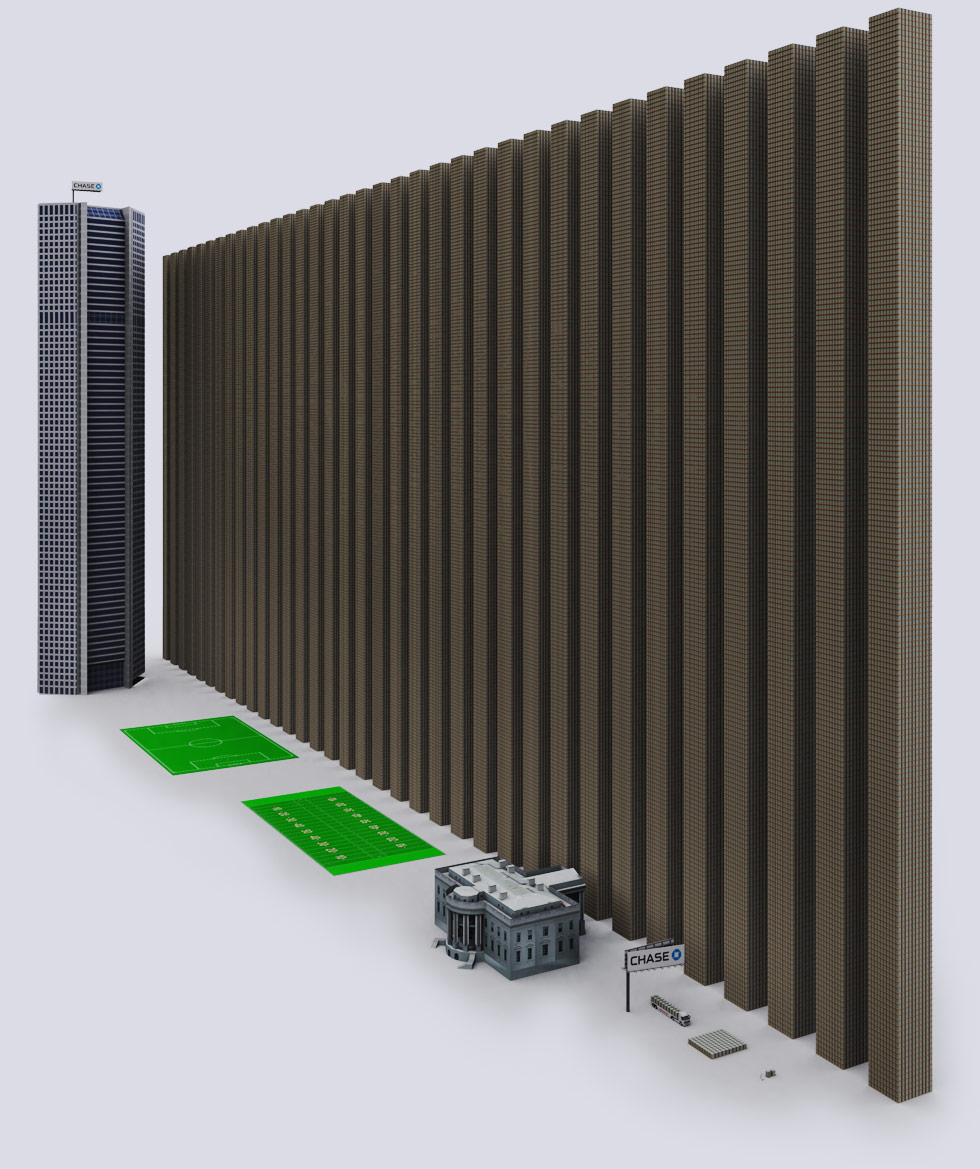

JP Morgan Chase |

| JP Morgan Chase has a derivative exposure of $70.151 Trillion dollars. $70 Trillion is roughly the size of the entire world’s economy. The $1 Trillion dollar towers are double-stacked @ 930 feet (248 m).JP Morgan is rumored to hold 50->80% of the copper market, and manipulated the market by massive purchases. JP Morgan is also guilty of manipulating the silver market to make billions. In 2010 JP Morgan had 3 perfect trading quarters and only lost money on 8 days. Lawsuits on home foreclosures have been filed against JP Morgan. Aluminum price is manipulated by JP Morgan through large physical ownership of material and creating bottlenecks during transport. JP Morgan was among the banks involved in the seizure of $620 million in assets for alleged fraud linked to derivatives. JP Morgan got $25 billion taxpayer in bailout money. It has no intention of using the money to lend to customers, but instead will use it to drive out competition. The bank is also the largest owner of BP – the oil spill company. During the oil spill the bank said that the oil spill is good for the economy. JP Morgan Chase also received a SECRET $391 billion dollar bailout from the Federal Reserve. |

9 Biggest Banks’ Derivative Exposure – $228.72 Trillion |

| Note the little man standing in front of white house. The little worm next to lastfootball field is a truck with $2 billion dollars. There is no government in the world that has this kind of money. This is roughly 3 times the entire world economy. The unregulated market presents a massive financial risk. The corruption and immorality of the banks makes the situation worse.If you don’t want to banks with these banks, but want to have access to free ATM’s anywhere– most Credit Unions in USA are in the CO-OP ATM network, where all ATM’s are free to any COOP CU member and most support depositing checks. The Credit Unions are like banks, but invest all their profits to give members lower rates and better service. They don’t have shareholders to worry about or have derivatives to purchase and sell.Keep an eye out in the news for “derivative crisis”, as the crisis is inevitable with current falling value of most real assets. Derivative Data Source: ZeroHedge |

South Carolina Takes the Next Step Towards a Gold Standard!

Last year Utah took a historical step and made gold and silver legal tender in their state. This was the first step of its kind and showed how Utah has lost faith in the dollar.

This week South Carolina took a huge step towards doing the exact same thing. The House Judiciary Committee passed the bill on in the legislative process. The bill in its current form would make the use of gold and silver as currency an option, but would not force business to accept gold and silver. Effectively what the bill does is allow individuals who want to protect their wealth to effectively go back on the gold standard by actually using gold and silver as currency. They also eliminate sales tax on these particular coins.

This major move started by Utah is spreading across the US and over 12 states are considering similar legislation at this time. At the end of the day E. Ray Moore, Jr., a member of the S.C. Money Committee, said it best, “It’s basically a form of discipline, so we can anchor our South Carolina economy in a time of great difficulty if the dollar continues to erode and inflation increases, which it inevitably will. So South Carolina could have a stable economy with this legislation. It would anchor our economy and gives us a stable currency.”

The Chart In Favor of Silver Manipulation

One of the ways that the silver price is manipulated is through the paper exchanges themselves. There are far more silver paper contracts that there are physical ounces. Despite this many investors ask, “Isn’t it normal to have such a disparity between the paper contracts of an asset and the actual supply of the physical asset?” To answer this question two different charts have to examined.

| Commodity | Daily Paper Volume Traded | Units | Exchanges | Daily Physical Production* | Trading Volume / Production Volume |

| Oil | 1,122,369,441 | Barrels | ICE, NYMEX, ICE Brent | 78,000,000 | 14.3 X |

| Aluminum | 7,234,954,585 | Pounds | Shanghai, LME | 154,440,000 | 46.8 X |

| Gold | 16,051,790 | Ounces | Comex | 230,000 | 69.7 X |

| Copper | 7,242,499,591 | Pounds | Shanghai, Comex, LME, MCI | 96,400,000 | 75.1 X |

| Silver | 286,120,771 | Ounces | Comex, MCI, Tocom | 2,000,000 | 143.0 X |

Source: Barclays, Sprott Research

Notice several things regarding the silver column. First, notice the physical daily production and the daily paper volume trade. The amount of paper silver traded each day is enormous in comparison to the actual supply mined each day. Second, notice the trading volume/production volume is 143. This is multiple times higher than any of the other examined assets.

In the last few months we have seen many examples of the manipulation that takes place. As an example, on February 29th over a ten minute period roughly 1.8 million ounces or $3 Billion, which caused a $40 drop in gold. At the end of the day, these charts are amazing because despite oil and most of the other assets being used as much or more as silver, silver is traded more than any of the other assets. In fact if you add the trading volume of all four other assets together they are only slightly higher than silver.

The Next Subprime Crisis: Student Loans?

In 2008, it was the subprime mortgage sector that unleashed the financial crisis. With the stock market at nearly the same level as it was in 2008, many investors question whether it can continue to rise so swiftly. Undeniably most of the rise that has occurred as a result of the QE that has taken place over the last four years. So the question is what event will set of the next 2008?

One potential option is student loans. Last year the student debt rose to over $1 Trillion. That’s right $1 Trillion. This is 1/15 the size of the US economy. Student debt is rising at a rate of about $40-$50 Billion per month right now. What makes this ticking time bomb even more dangerous is that roughly 27% or $270 billion of all student loans are 30 days past due. Fitch made this information public recently in the following statement:

“Fitch believes most student loan asset-backed securities (ABS) transactions remain well protected due to the government guarantee on Family Federal Education Program (FFELP) loans. The Federal Reserve Bank of New York recently reported that as many as 27% of all student loan borrowers are more than 30 days past due. Recent estimates mark outstanding student loans at $900 billion- $1 trillion. Fitch believes that the recent increase in past-due and defaulted student loans presents a risk to investors in private student loan ABS, but not those in ABS trusts backed by FFELP loans.”

So right now many students are struggling to pay back their student loans and what is scary is that this number does not include individuals who are barely making it right now or are using other forms of debt like credit cards in order to continue to pay their student loans.

On top of all this, unemployment amongst this particular groups of individuals is at an all time high. Look at the two charts below. There are so many individuals in this particular group that are unemployed and many more graduating from college every year and are not able to find a job or are under employed. This simply means they are working less hours than they want or are making less money than they normally would given their work experience and education.

At the end of the day, student loans are a massive stack of dynamite with more stick being added to the pile each month. Investors will need to keep an eye on this dangerous minefield.

When is QE3 Likely to Take Place?

This morning both gold and silver took a pretty major jump as the dollar took a dive. Why did the dollar dive? Ben Bernanke spoke at a National Association for Business Economics meeting this morning in which he made the following statements:

“To the extent that this reversal has been completed, further significant improvements in the unemployment rate will likely require a more-rapid expansion of production and demand from consumers and businesses, a process that can be supported by continued accommodative policies.“

He later said: “I will argue today that, while both cyclical and structural forces have doubtless contributed to the increase in long-term unemployment, the continued weakness in aggregate demand is likely the predominant factor. Consequently, the Federal Reserve’s accommodative monetary policies, by providing support for demand and for the recovery, should help, over time, to reduce long-term unemployment as well.”

There are two main reasons for the silver price having so much volatility at the beginning of this year. First, there has been some major market manipulation taking place. Second, Ben Bernanke has made so many different contradictory statements in regards to Quantitative Easing or Accommodative Policies that investor buy or sell multiple times based on what he says.

However, we do know several things for a fact. First, this year is an election year and the powers that be have every intention of making sure that the year remain stable or get better in the short-term in order to make sure that the elections go smoothly. Second, every time a round of QE finishes it is a matter of a few weeks, not months before the next round gets rolled out. After each round of QE the stock market takes a dip only to be stopped by the next round of QE. Take a look at the chart below where the S&P 500 is overlapped with the different rounds of QE.

Operation Twist, the latest quasi QE will be ending on June 1st of this year. Therefore it is extremely likely that we will see the next dose of QE come between now and July of this year. Most economists believe that the QE will be at least another $500-$750 Billion. However, one thing that we have to remember is that like a drug each time QE is taken it becomes less effective and larger and larger doses have to be taken in order to attain the same result. Be watching for an announcement by the Fed sometime between now and June of this year. Whenever QE has been introduced by the Fed, gold and silver have made major moves to the upside. The dollar right now is in a major technical pattern called a flag as seen below.

Typically when an asset gets to the end of the flag it makes a major move either down or up. Watch the dollar very carefully over the next couple of weeks to see if it gets below the 78 mark or above or the 80.5 mark. Both moves would be extremely significant for both gold and silver.

Turkey Encourages Gold to Be Returned Home

While Ben Bernanke may think gold is not money nearly every other country says otherwise by either their words or actions. This week Turkey was one of those countries. Right now Turkey is in a huge financial scrape. They are currently running a 10% deficit as a country and now they are trying to persuade Turkish nationals to transfer their vast personal holdings of gold and other wealth back into the country’s banking system

For those who don’t know, Turkey has a history of economic volatility. As a result of this history many Turks choose to store their wealth in banks outside the country. The new initiative by domestic banks will try to create large incentives for natives to bring their gold back home. One idea that was discussed was a new interest-yielding gold-deposit accounts that would allow savers to withdraw gold bars from specially designed automated teller machines.

While Turkey is not on the gold standard, some economists believe that because of the vast gold ownership by individuals it has effectively created a defacto gold standard. As a result of this these same economists also believe the Turkey could be setting the stage for a gold confiscation order similar to what FDR executed in 1933.

In any event, it is obvious that Turkey recognizes gold to be money and it is important that Americans do as well if they are going to protect their wealth.

Should I Buy Junk Silver?

This is question many investors have considered when deciding what kind of silver to purchase. At Lone Star Bullion, we believe it is critical that investors consider their financial goals and reasons for investing in gold and silver to determine which kind of gold or silver to purchase.

Many coin shop and online dealers heavily push junk silver, emphasizing how cheap the junk silver is. Of course what most dealers never tells clients is what the resale value on junk silver is. While many investors can pick up junk silver at a cost very close to spot and sometimes slightly below spot, when it comes time to sell junk silver, most dealers will not buy junk silver back at anything above $2 below spot and many companies will pay as low as $4 or $5 below spot. This effectively means that an investor takes an automatic 6-14% hit depending on whom they sell their junk silver to. So why do coin shops and online dealers push junk silver? The answer is the commission is usually two to three times higher than any other silver bullion product out there and while some dealers may have good intentions, they have not evaluated the client’s goals.

It is always important for gold and silver investors to consider the real cost principle. They must ask both how much does it cost to buy the silver and how much will I lose when I sell it back.

Some investors believe that junk silver would make a good means of exchange in the event of an economic collapse. They emphasize the small denominations as the key factor. There are several problems with this line of thinking. First, junk silver is not an easy denomination to use. How many ounces of silver are in $1 of junk silver. 99 out of 100 people don’t have a clue or answer incorrectly and one of the first things a form transaction must have is easy to use and recognized denominations. $1 of junk silver is .715 ounces and this simply is not a form many individuals can use well because of the odd fractional value. Second, most forms of junk silver are far to small to be used in transactions. How many people do you see carrying around thousands of dollars in $1 bills? It’s just not a viable form for transactions. Even the largest form of junk silver is less than ¾ of an ounce. At the end of the day, junk silver has a horrible resell value and simply is not practicable for any form of exchange

Municipality Defaults in 2012 or the Near Future?

In 2010, Meredith Whitney came on 60 minutes predicting a full-scale municipal bond defaults that would take place. She predicted that the defaults would happen in 2010 and her predictions did not come about. However, Whitney’s overall point is spot on. When you look at the fundamentals the municipalities they are in horrible shape.

While municipalities did not do as bad in 2010 as Whitney predicted Municipal defaults did rise 5.5 per year in 2010 and 2011, from 2.7 in the previous 39 years, Moody’s Investors Service says in a report.

When Whitney was asked about her failed predictions she responded by saying “They’re not called technical defaults. It took how long for Greece to become a technical default, so they’re insolvent, they’re not paying their bills,”

“So there’s been every effort on the part of the states to prevent this tidal wave of defaults, which is going to happen sooner or later. It’s happening at an accelerating pace.”

When asked which cities do you think will get hit the hardest Whitney responded, “You have Stockton that is on the brink of bankruptcy. You have five cities, including Detroit, which is on the brink of insolvency. It’s fascinating, because there’s been so much back-room political maneuvering to keep these cities from going bust,”

At the end of the day Whitney said it best, “You’re either willing to see it or you’ll shut your eyes, and if people want to tell me, ‘Oh, I was wrong,’ because this hasn’t played out, stay tuned.” In the future, we will see the effect of frivolous spending by state and local governments and their ability to pay.

When is QE3 Coming?

This is a question that nearly every investor regardless of whether they are investing in gold, silver, other commodities, or the stock market are asking. Many economists have predicted from the beginning of the year that we would at least see one more round of QE if not more.

Up to this point, the Fed has made several statements, which have been considered negative towards the short-term precious metals outlook. They stated last month that the economy was doing better than they expected. This small statement caused everyone to think that no QE would be forthcoming for the foreseeable future. However, the Fed’s track record for communicating clearly is not that good. Look at the major press releases for this year so far:

- Jan 25 – “moderate, yet slowing” – extends zero % rates 1 year

- Feb 29 – “uneven and modest” – adds that he will provide more stimulus if necessary

- Mar 07 – Floats Extension of Operation Twist style printing

- Mar 13 – economic growth upgraded from “modest” to “moderate”

- Mar 14 – economic growth “frustratingly slow”

If that’s not confusing communication I don’t know what is. The latest comment from the Fed is positive towards precious metals. Two major movers in the investment community came out this week stating they believe more QE is on the way and it will be here soon.

First, Goldman Sach’s Jan Hatzius came out and said that more QE(at least $500-$750 Billion) will be forthcoming as early as next month or no later than June. The stated reason for their belief was “The improvement might not last.” In other words, unless the “economic improvement” is guaranteed in perpetuity, the Fed will always ease.” Goldman Sach’s has influencial people working at both the Federal Reserve and also at the US Treasury and have a better outlook than potentially any other mainstream financial institution on QE.

Also Pimpco’s Bill Gross came out and stated in an interview question about QE that “I think there has to be Dan. I believe there will be a QE3 and perhaps a QE3 and QE4.” Pimpco currently manages the largest bond fund in the world and Bill Gross has made good decision after good decision when it comes to market timing over the years.

There is one final reason that suggests that QE3 is likely to come sooner rather than later. This year is an election year and the powers that be have a very strong incentive to keep things stable for the time being. The only way they have historically been able to do that is through QE. Therefore it is imperative that they inject QE3 soon in order to allow its affects to rivet through the market so they can get the full benefit in the 2012 elections. However QE is like a drug. Each time the United States takes it, it takes more and more QE to have the same effect. Eventually the US will overdose.

← Older posts