BLOG

Japanese Finance Minister Says, “Japan is Fiscally Worse Than Greece.”

The Japanese Finance Minster, Yasushi Kinoshita, stated that, “”Japan is fiscally worse than Greece.” This statement is huge. At a conference in Japan, the Finance Minister also noted that in 2011 Japan ran a 10% deficit and their debt to GDP ratio skyrocketed to over 230%. When we look back at economic history when a country breaks through the 160% debt to GDP number they usually have either economic collapse or a currency crisis. Only Great Britain during its imperial might in the 1700 and 1800’s were able to come out of a debt load this large. What makes all this particularly interesting is that most of Japan’s debt is held domestically. Because of this the Japanese financial system will be much more susceptible to fiscal shock.

An additional piece of news makes the statement by the Japanese Finance Minister even more serious. This year alone Japan will have to pay back in full nearly $3 Trillion, nearly 25% of all the debt they owe. Financial stability will be completely dependent on the old bondholders being willing to simply reinvest their money in the new bonds. If bondholders don’t reinvest Japan will have to look for new investors. This year of all years it will be particularly hard to get new bondholders because so many countries have debt coming due like Japan. There are far more options than investors at this point. Therefore, Japan could be looking at an escalation of a fiscal crisis.

Japan Buys Chinese Debt for First Time in History!

This week marked yet another historic event in the debt crisis. For the first Japan has agreed to invest in Chinese debt. What truly makes this amazing is that China has to approve all government holders of their bonds. So Japan up to this point has never been approved. China originally approved Japan late last year, but no action has taken place until now.

However, what is truly significant here is that China and Japan are cementing a monetary relationship between their two countries. While the amount of the debt is relatively small, only $10.3 Billion, this is still a massive change in the geopolitical atmosphere in the region. It shows that Japan recognizes China as a growing leader and a need exists to be on good terms. On the other hand, this actions also points to the weakness of the United States as Japan is now looking towards other nations to have their reserves invested in.

China is still establishing its strength as a global leader. In just a few years it will have the largest economy in the world, but until its currency is recognized as one of the main strong currencies in the world, it will always take a back seat next to the United States.

Major Silver Shortage by August 2012?

In my research this week, I came across a couple of articles that were particularly interesting. They made the case that a silver shortage could be exacerbated by as early as August of 2012. The first reason given was that currently there is a majority of long positions on silver in comparison to the shorts in place. As we speak, there are currently 2 long positions in silver for every one short position. This is truly amazing considering the massive short positions that have been held by major financial institutions like JP Morgan Chase and others. This disparity in short positions compared to long ones shows how the overall disposition toward gold and silver now are changing.

Mining Strikes

The second reason brought up was the major silver mine strikes in both South Africa and Indonesia. In South Africa, a one days strike was held in which tens of thousands of miners came out in opposition to current working conditions and wages. In the Gold Fields mines in South Africa 85% of workers stopped working leaving mining activity virtually at a stand still. Gold Fields is the world’s fourth largest producer of gold. These strikes right now have only had a small impact on supply provided, but if they continue they could significantly reduce the supply readily available on the market today. As if that is not enough many mining company are reportedly keeping larger quantities of silver as a reserve than before, which also places stress on the world supply.

Fuel Prices and Slow Economy

Third, most economists expect the price of oil to go up dramatically over the summer. Many economists have estimated between $4.50 and $6.00 a gallon. This major increase in fuel cost will also affect mining costs, which will increase the cost to the consumer. Additionally, when fuel prices increase it usually means an economic slow down. In these types of situations other metals like zinc, copper, and lead typically have reduced demand. Right now approximately 75% of all silver mined comes as a byproduct of mining other metals like zinc, copper, and lead. Thus a reduction in the demand for these metals will also reduce the available silver from mining activity.

Iranian War?

Finally, many experts believe a war with Iran is eminent. If such a war were to break out the effect on silver would be dramatic. Silver is used in a large number of military products. The United States does not have a large mining industry in comparison to the rest of the world and would be very dependent on foreign allies. There is also a strong possibility if war is declared with Iran that both Russia, China, and many other socialistic and communistic nations might not sell us large amounts of the metals any more due to their close ties with Iran.

How Likely?

Do I believe that a shortage will happen by August. At this point it there are too many what ifs, but the important point is that it would not take much for a shortage to develop quickly. So regardless of whether or not a silver shortage takes place in August or three years from now investors need to be ready.

Germany and Switzerland Demand the Return of their Gold!

This week saw two huge developments in the gold and silver world. Earlier in the week Germany request that its 3,396.3 tons of gold be transferred from being held abroad to local storage. Germany right now is one of the top 4 holders of gold as a reserve in the world.

Merely days later Switzerland also announced that they were seriously considering moving their 2,590 tons of gold that are currently being held abroad back to Switzerland. In fact, the Swiss parliament will be considering three different initiatives. First, the government would require that all Swiss gold must be held in Switzerland. Second, the government would be prohibited from selling any of the Swiss gold reserves. Third, the government would be required to always keep 20% of all the country’s reserves in gold. Switzerland currently is the worlds fourth larger holder of gold reserves.

Both of these steps are huge in the international community. In the past, most countries have never physically held their gold. Why? Most countries never saw a need to do it. As long as the global economy was perceived to be stable there was no reason for the gold to be held domestically. The fact that two of the top four gold holders are now deciding or considering moving their gold back to their own countries show that both countries are losing confidence in the stability of the global economy and recognized the need to have their reserves at home.

Both of these statements from the Swiss and Germans comes only months after Venezuela chose to have their 100 tons of gold returned to Venezuela from England. As the financial system continues to deteriorate don’t be surprised if we see more and more countries determine to hold their gold domestically.

Fiat Currencies Assaulted by Brazil!

History was truly made last week. In a historic speech given by Guido Mantega, the Brazilian Finance Minister declared a new “currency war” to battle the overactive printing presses around the world.

In full Mantega stated, “Brazil has declared a fresh “currency war” on the US and Europe, extending a tax on foreign borrowings and threatening further capital controls in an effort to protect the country’s struggling manufacturers.”

During times of recession, many countries attempt to devalue their currency in the short-term in order to give them a short-term advantage when competing against international markets. Brazil is one of the first governments outside of several middle-eastern countries to denounce the United States and Europe for their extravagant inflationary policies. It is important to note that it is a crisis of confidence that will eventually put an end to the inflationary policies of the United States, Europe, and several other major nations. This crisis of confidence will first start outside the United States and then finally after most of the world has lost confidence in the country’s currency then that same confidence crisis will be transferred to the country itself. Therefore, the significance of the denunciation of the United States and Europe by Brazil cannot be underestimated.

European Commission Threatens to Fine Spain for Budget Deficit!

Mere months after the inception of more stringent fiscal requirements, the European Commission is threatening to impose strict fines on Spain for a “grave breach of budget limits.” It was only recently that the European Union ruled that it would give the central authority more control over each individual county’s budgets. Despite this decision, Spain deviated from the fiscal standards. The European Commission goal is set at 3% of GDP. Originally, Spain had been targeting a 4.4% deficit, but over the past few weeks had changed their target to 5.8% of GDP.

Talking to reporters during a visit to Vienna, Mr Barroso said the Commission had not yet seen Spain’s 2012 budget and needed more information about the “slippage” Madrid had in 2011 so he could not comment in detail.

But he added: “I have no doubts that the government will honor its commitments with respect to the stability and growth pact.”

Prime Minister Mariano Rajoy insisted he was acting within EU guidelines because the plan was still to hit the European Union public deficit goal of 3pc of gross domestic product in 2013.

This initial infringement on the new fiscal standards will be the true test for the European Union on whether they will legitimately try to salvage any part of the EU from fiscal disaster. If the EU is not hard enough on Spain, it will show every other country in Europe that it is business as usual and that large deficits and accumulation of debt is fine. This will result in the Europe going down the drain even faster than they already are.

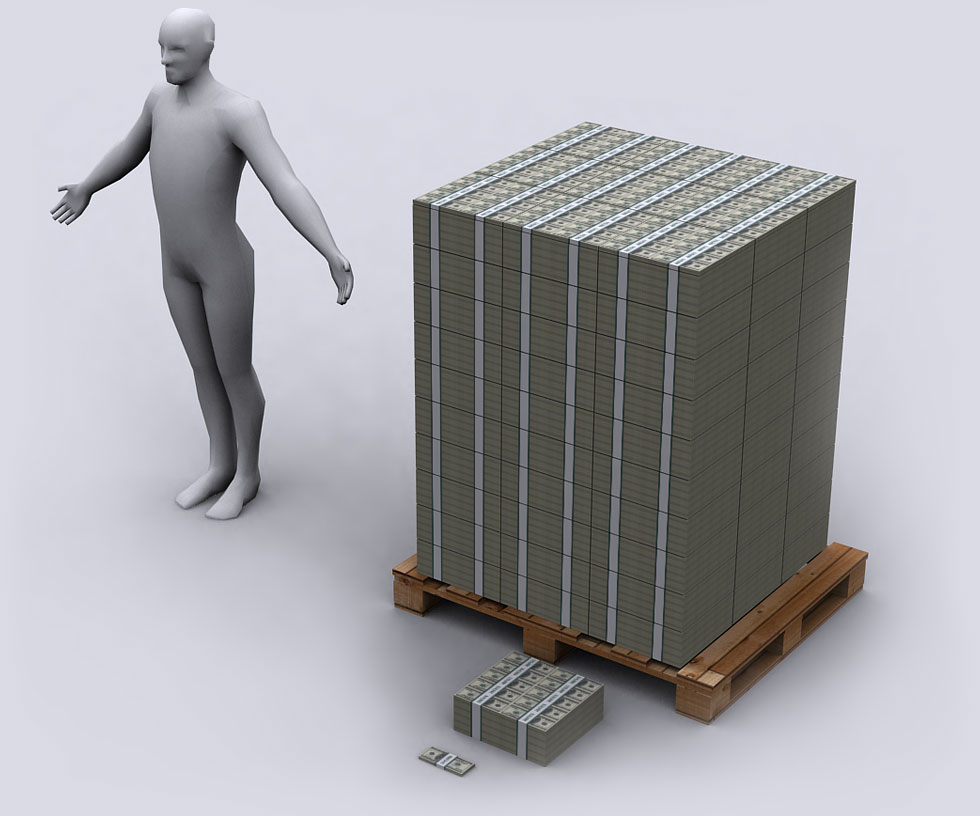

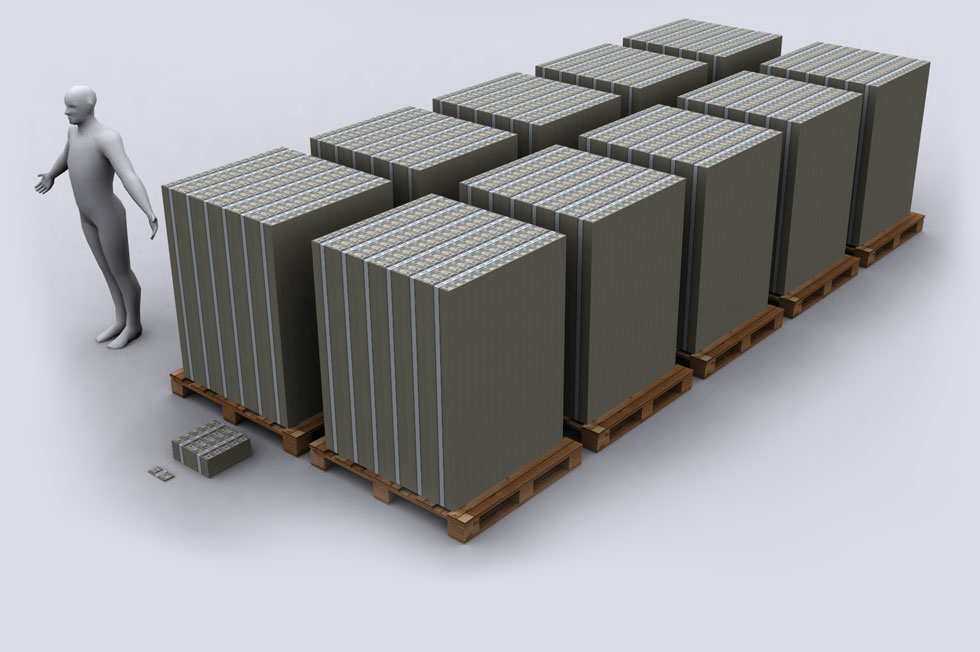

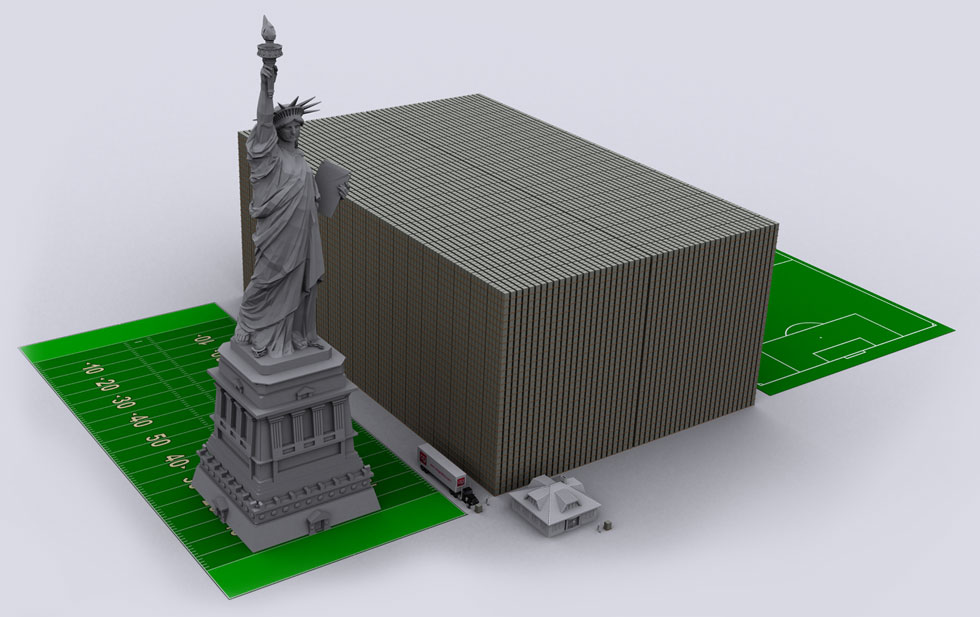

What Does the US Debt Look Like?

$100

$10,000

$1,000,000

$100,000,000

Plenty to go around for everyone. Fits nicely on an ISO / Military standard sized pallet

$1,000,000,000

$1,000,000,000,000

When the U.S government speaks about a 1.7 trillion deficit – this is the volumes of cash the U.S. Government borrowed in 2010 to run itself. Remember that it is double stacked pallets of $100 million dollars each, full of $100 dollar bills. You are going to need a lot of trucks to freight this around. If you spent $1 million a day since Jesus was born, you would have not spent $1 trillion by now…but ~$700 billion- same amount the banks got during bailout

$15,170,600,000,000 is the Total Debt of the US Government

United States now owes more money than its GDP. It’s debt to GDP ratio is 100%. The United States national debt will soon to pass 20% of the entire world’s combined GDP.

Spanish Treasure Ship of 544,000 Ounces of Silver to be Returned to Spain!

In May of 2007, a Spanish Galleon named Nuestra Senora de las Mercedes was discovered by an American group of treasure hunters called the Odyssey. After all the contents were taken from the wreck, the total amount of silver discovered amounted to 17 tons or 544,000 ounces of silver.

544,000 Spanish Coins Ready for Transport

Sunken Wreckage

After the discovery of this great treasure ship, a case was brought before a U.S. Court to determine the rightful ownership of the lost treasure. As of last week, U.S. Court sided in favor of the Spanish Government. So over the next couple of months, all of the silver will be transported to facilities owned by the Spanish Government. In the meantime, Odyssey will continue to fight in court for possession of the silver arguing that the Spanish government never had possession of the ship in the first place. However this legal battle is decided an additional 500,000 ounces of silver will now be added to the above ground supply as a result of this huge discovery.

102,500,000 Paper Silver Ounces Dumped on the Market in 7 Minutes!

We are starting to see more strength in silver than arguably ever before. Late last week silver was getting dangerously close to breaking above $35.50 an ounce which would have launched silver to the next major resistance point at $40 an ounce. Notice what happened on February 24th on the chart above.

Notice on the center of the screen how the lines get much larger and red. This occurs when larger amounts of paper contracts are sold. To be specific, 20,500-paper silver contracts were dumped during this short 7-minute sell off. This effectively amounts to 102,500,000 ounces of silver being dumped on the market in less than 10 minutes. This is not a normal thing to see. Notice on both sides of this seven-minute time frame how small the lines are. This is normal trading volume. For 102 million ounces to be suddenly dumped on the market like this strongly indicates that manipulation is taking place.

However, what is incredibly encouraging is that despite the massive sell off silver hardly flinched and still closed the week at slightly over $35.50 an ounce. This indicates that there was likely another large buyer who snapped the contracts as soon as they hit the market. Therefore, silver is in a very good position to move up to touch the $40 an ounce price in the next two to four weeks.

Will the Government Confiscate Gold?

Gold Confiscation: Executive Order 6102

This is a one of the most important questions asked by gold and silver investors. This question is largely asked because of what gold and silver investor have heard concerning Franklin D. Roosevelt’s Executive Order in 1933. So the first thing we have to do is look at the reasons behind this confiscation. Executive Order No. 6102 issued by Franklin Delano Roosevelt outlawed the ownership of gold. The government bought back gold at $20.67 an ounce from the public in accordance with eminent domain law. There are a couple of important things to note about the confiscation. First, almost all the gold that was confiscated was voluntarily given up. All other gold that was confiscated was held at banks or by very large investors. So even this confiscation was not comprehensive or effective.

However for us to truly answer this question we have to ask , “Why would a government choose to confiscate gold?” There are two main reasons. The first reason a government would confiscate gold is in order to gain additional funds in order to deal with fiscal hardship. And the second reason would be in order to inflate the money supply.

The Real Reason for Gold Confiscation

Most gold and silver investors believe confiscation is likely because they only are considering the first option. Most investors in gold and silver believe that is why Roosevelt confiscated gold. However, this simply isn’t true. In 1933, the United States was on the gold standard, which meant that every dollar in circulation was backed by physical gold. This meant that FDR could not simply print money in order to finance his massive spending and this is why FDR ended up confiscating gold. He could not inflate the dollar until he controlled the value of the gold. It is important to note here that the US government held 68.2% of the world’s supply of gold at the time. Once Roosevelt made gold ownership illegal, he immediately raised the price of gold to $35 an ounce. This immediately devalued the dollar by 40% over night. This is truly the reason why Franklin Delano Roosevelt confiscated gold. Therefore FDR would not confiscate gold today because the Fed now has the ability to inflate the money supply without controlling the gold supply.

Retirement Account Confiscation?

The real question when it comes to confiscation is would the US government confiscate gold because they were in a fiscal straight. I think the answer is no. Gold holdings are very small in the US. At most we are talking about several billion dollars. If the government was truly in need of funds there would be several larger and more obvious targets. The first and most obvious one is retirement accounts. According to the Investment Company Institute there was $7.835 trillion in IRA, 401K, 457, and 403b accounts in 2009. All gold and silver holdings in the United States are a miniscule fraction of this huge source of wealth. There is also historical precedent for government confiscation of retirement accounts especially in socialistic and communistic countries. Even if the government attempted to confiscate gold, the task would be enormous. The logistics of attempting a house to house search for gold and silver would be massive and would hardly be worth the man power and money that would have to be used in order to confiscate it. In the end, the chance of the government confiscating gold and silver seems extremely small.

← Older posts Newer posts →