BLOG

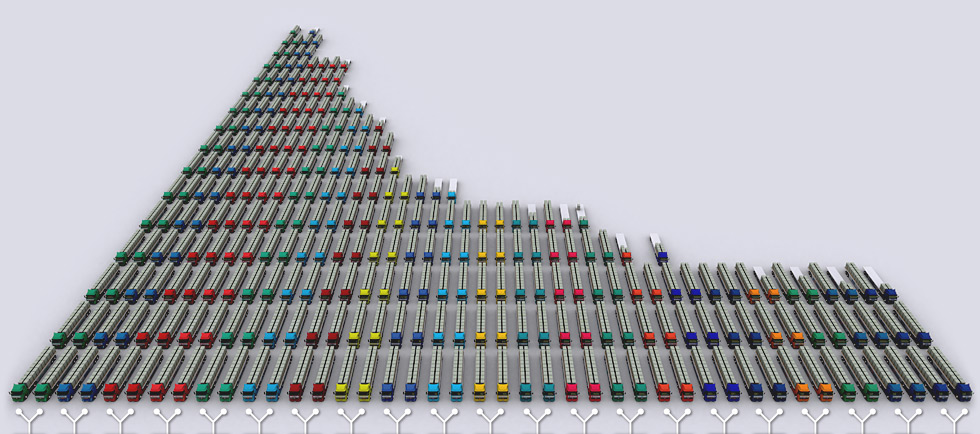

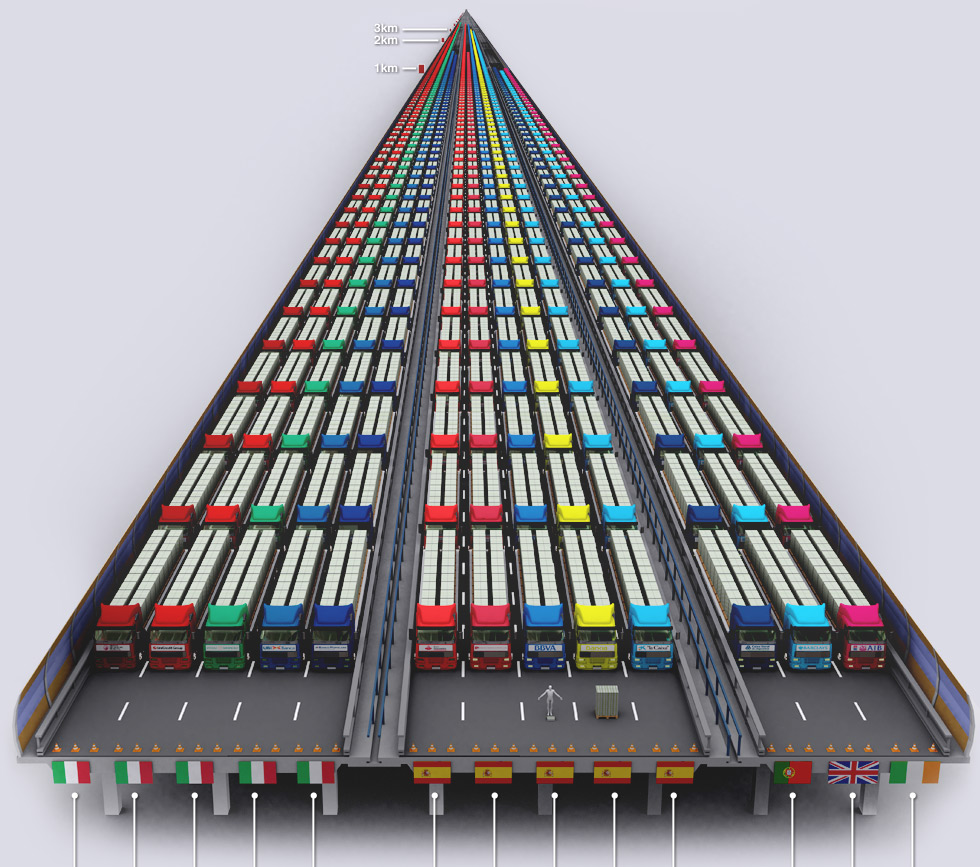

How Much Debt Does Portugal, Ireland, Italy, Greece, and Spain Owe?

€10,000 Euros

€10 Million

€100 Million

Is There Silver Price Manipulation?

Are gold and silver prices manipulated? The answer is a resounding yes. Silver is traded around the clock and around world in the commodity markets of New York, Chicago, London, Zurich, Paris, Hong Kong, Shanghai, and Sydney. The trading of silver goes back to the 17th century with the London markets and to this day London remains the center of the physical silver trade for most of the world.

COMEX

However, it is important to note that the COMEX division of the New York Mercantile Exchange is the most important paper contracts trading market for silver. The silver price or silver spot price is determined by the COMEX. While the buying and selling of physical silver affect the silver price, paper silver is by far the biggest market force driving the silver price higher or lower. It is estimated by economists and precious metals experts that the ratio of paper silver contracts to physical metals is between 100 and 200 to 1. Some experts go as far as to say that the ratio could be as high as 500 to 1. Why is this significant? A common misconception amongst investors is that when the silver and gold price falls there is a larger amount of physical metal on the market, but this simply isn’t true. It is extremely likely in the current environment to see the price of silver and gold fall and not be able to get a hold of physical silver. A great example of this was back in 2008. During this time silver fell to $9 an ounce and so many investors wanted to get in, but very few investors could buy the physical metal. Why? Because while paper silver was being sold investors holding physical metal were hording and were only buying more.

Exchange Manipulation

What silver investors need to realize is that the exchanges themselves are a manipulation of the silver prices. As a silver investor myself, I view this as a positive thing, because it allows me to purchase physical silver at prices I would never be able to access if the market was based solely on the physical supply. Having said this, silver investors must also realize that at some point there will be a run on the exchanges. Any investor holding a paper silver contract can request delivery. The problem is that currently on average only 1% of all paper contracts actually request physical delivery. The COMEX division does not have nearly enough metal to meet the demand that would arise if a run on the exchanges occurred. The inevitable result would be silver prices shooting through the roof as the available above ground stock of silver would be completely exhausted within a very short period of time.

Bank of England Authorizes Another £50 Billion in Quantitative Easing!

Bank of England Quantitative Easing

I have said over and over again that this year will be a year with an extrordinary amount of quantitative easing and government stimulus. As a result of this it will be one of the best years for gold and silver to date. Today, the Bank of England unrolled another round of quantitative easing amounting to £50 Billion. This brings the total amount of quantitative easing put out by the Bank of England at £325 Billion since March of 2009.

The Effect of Quantitative Easing

The only possible result of such action is continued inflation. In fact, research from a financial services company called Hargreaves Lansdown found that a 65-year-old man with £100,000 could have bought a level income of £7,855 in July 2008, but someone in the same situation today would only receive an income of £5,923, a drop of just under 25pc.

More Federal Reserve Quantitative Easing?

England is beginning to see the practical impact of an inflationary monetary policy and it is not looking pretty. These monetary policies are especially harmful for retires who have static incomes and have no way of fighting against the inflationary forces that hack away at the real value of their income. Ironically, one of the reasons the Bank of England has launched this new round of QE is because of fear that inflation will fall below the Bank of England’s target inflation rate of 2%. It was just two weeks ago that Federal Reserve Chairman Ben Bernanke came out and said that the Fed would now establish a target inflation rate of 2%. This move by the Federal Reserve is setting themselves up for the next round of QE. Many economists fully expect to hear about a new round of QE before the end of the summer.

An Unbelievable History of World Debt!

Massive International Debt Crisis

History of the Debt Crisis

Pimpco’s El-Erian Gives Gold a “Thumbs Up”

The Past “Snubbing” of Silver and Gold Investing

Many individuals have snubbed their noses when it comes to gold and silver investing over the last couple of years. They have pointed at all the major mutual funds and other economists who have slammed gold and silver. Of course like most good investments the mainstream investor does not begin to catch on until well into the first stage of growth. Over the past ten years, silver and gold have both done extremely well boasting over 760% and 550% respectively.

Pimpco’s El-Erian Thumbs Up to Gold Investing

Over the past few months several major players in the mutual fund world have come out and given their stamps of approval for gold, silver, and commodities in general as assets that will perform well over the next couple of years. One of the biggest recommendations comes from Mohammed El-Erian, who is the CEO and Co-Chief Investment Officer of Pimpco. Pimpco manages the largest mutual fund in the world, Pimpco Total Return and several other very large mutual funds. In the video above he gives his reasons for why he believes both gold and oil will be good performers in the near-term.

Ben Bernanke Says the US Could Be Greece!

Ben Bernanke said in testimony before congress basically that if the United States did not change their fiscal path they would be in Greece’s situation.

Bernanke said, “Even the prospect of unsustainable deficits has costs, including an increased possibility of a sudden fiscal crisis. As we have seen in a number of countries recently, interest rates can soar quickly if investors lose confidence in the ability of a government to manage its fiscal policy. Although historical experience and economic theory do not indicate the exact threshold at which the perceived risks associated with the U.S. public debt would increase markedly, we can be sure that, without corrective action, our fiscal trajectory will move the nation ever closer to that point.”

It is amazing that Bernanke is saying this especially in light of the Federal Reserve’s policy decision up to this point. His statement today will only fuel the flames of silver and gold and investing silver will only be more attractive.

Where to Buy Silver in Houston

Where to buy Silver in Houston? Should I even consider buying silver coins locally or should I buy them with an online company? These are all questions that gold and silver investors should ask.

Advantages of Buying Silver in Houston

There are many advantages to buying gold coins in Houston from a local company. First, an investor can save money by avoiding the shipping and insurance charges. These charges are usually $20-$55 per order depending on the company. Second, when you as an investor buy gold from a local company, you can examine the merchandise, pay for it, and the transaction is done. You don’t have to monitor the online payment, wait for the shipment, and worry about the shipment coming while you are not home. Third, you as a buyer of gold in Houston get to form a relationship with an individual and company who can help you sell the gold when the time comes and also give you advice on exiting the gold market.

Should I Buy Silver Coins at a Coin Shop?

Should you buy gold coins from a coin shop in Houston? Unfortunately there are far to many disadvantages to buying gold from a coin shop. First, most coins shops have very uncompetitive prices. On average my company is between 2-7% cheaper than most coin shops in Houston. Second, in many cases there is a complete disregard for investor privacy. Silver and gold dealers are required by law to obtain an investor first and last name and nothing more. However, many coin shops in Houston require that you show your drivers license and in many cases they will keep a copy on file. Finally, most coins shops don’t have firm understanding of economics and as a result their recommendations on which gold to buy is often not based on the most important and relevant information.

Should I Buy Silver Numismatic Coins?

Should you buy silver numismatic coins in Houston? There are three major reasons why silver numismatic coins will be a bad investment over the next decade. First, one of the main reasons investors consider buying silver numismatic coins is they have been told that they can’t be confiscated by the federal government. Most investors believe this because of Roosevelt’s confiscation of gold in the 1930’s. However, this simply isn’t true. In 1933, the United States was on the gold standard, which meant that every dollar in circulation was backed by physical gold. This meant that FDR could not simply print money in order to finance his massive spending and this is why FDR ended up confiscating gold. He could not inflate the dollar until he controlled the value of the gold. It is important to note here that the US government held 68.2% of the world’s supply of gold at the time. Once Roosevelt made gold ownership illegal, he immediately raised the price of gold to $35 an ounce. This immediately devalued the dollar by 40% over night. This is truly the reason why Franklin Delano Roosevelt confiscated gold. Therefore FDR would not confiscate gold or silver today because the Fed now has the ability to inflate the money supply without controlling the gold supply. Second the Government is also to not likely confiscate gold or silver in order to gain extra funds when they could confiscate the $7.3 Trillion rapped up in retirement accounts today, which they already regulate and control in many ways.

The second reason investor consider buying silver numismatic coins in Houston is because they believe that they have to report purchase of gold and silver bullion to the government, but not for numismatics. Once again, this simply isn’t true. Neither numismatic coins nor bullion require any reporting when they are bought and it is only when silver is sold back to a dealer in excess of 1000oz or in gold in excess of 25oz at a time that a dealer has to report anything to the government.

The final reason investors consider buying silver numismatic coins in Houston is because they believe that numismatic coins will outperform regular bullion. However, when an investor examines all the factors this is quite unlikely. First, if the price of silver or gold goes up will numismatic coins or bullion perform better? Let’s say for example, silver goes up 177% from $18 to $50, then a one-ounce numismatic collectible coin valued at $100 is likely to go up by only 32% to $132. The collectible coin will go up based on the silver it contains, but there’s no reason to think the numismatic premium will increase too. On the other hand the same $100 in bullion is now worth $277, a difference of 145%!

Numismatic coins owe their value above the silver cost exclusively to their rareness and collectability. Historically, during times of economic hardship these types of purchases do very poorly because the demand for them drop and as a result the premium over the price of gold or silver charged goes down. So in some cases it is possible to see the price of silver and gold go up and the value of numismatic gold and silver coins go down!

A salesman might have a chart showing the performance of “rare/collectible/numismatic coins” against “regular/bullion coins.” Of course, the chart shows the numismatics performing much better. But these graphs inevitably track particular rare coins, which are cherry-picked with the benefit of hindsight. For every one rare coin that outperforms, there could be ten to twenty that severely underperform. Only afterward would you know which coin you should have bought. Additionally performance charts often omit the dealer’s high markups and markdowns that would more than wipe out the alleged profits for retail investors. In the end, investing in numismatic coins is far inferior to bullion.

Buy American Silver Eagles in Houston and San Antonio

The American Silver Eagle is one of the most desired bullion coins in the world. During it first year of minting in 1986, nearly seven million coins were sold, but by 2010 over thirty five million coins were purchased with nearly 260 million coins being sold since its inception.

American Silver Eagle Description

The American Silver Eagle is a 1 troy ounce coin, .999 pure silver coin, that was first minted on November 24th, 1986. It is the only silver coin whose weight and purity are guaranteed by the United States government. Additionally it is one of the few coins that can be held in retirement accounts such as IRA’s. This is also the only coin that dealers are not required to issue 1099s for when they buy them back from the public. The Silver Eagle has been produced at three mints: the San Francisco Mint, the West Point Mint, and the Philadelphia Mint. Although today they are only minted at the West Point and San Francisco Mint. Today they are the most sought after bullion investment coin in the world.

The front side of the coin was designed by John Mercanti. This side displays a heraldic eagle behind a shield. The eagle grips in his right talon an olive branch and in its left talon arrows, echoing the beautiful seal of the United States. Above the Eagles is thirteen five-pointed star representing the thirteen original colonies. On this side of the coin are inscribed the phrases: UNITED STATES OF AMERICA, 1 OZ. FINE SILVER~ONE DOLLAR, and E PLURIBUS UNUM.

On the flip side, the coin has always featured a rendition of sculptor, Adolph A. Weinman’s magnificent Walking Liberty Design, originally commissioned and executed for the Nation’s first circulating half-dollar in 1916. Inscribed on this side of the coin are the phrases: IN GOD WE TRUST, LIBERTY, and the year in which the coin was minted.

American Silver Eagle History

What originally pushed the American Silver Eagle coin into production were executive plans in the 1970s and 1980’s to sell of the Defense National Stockpile of silver. Most mining companies were afraid of what would happen if the government dumped such a large stockpile of silver all at once on the market. So in the end the United States government agreed to slowly sell of a portion of the silver in the form of the American Silver Eagle as authorized by the Liberty Coin Act of 1985. The American Silver Eagle bullion program stipulated that the silver use to mint the coins must be acquired from the Defense National Stockpile with the intent to deplete the holdings slowly over the next decade. By 2002 nearly all government stockpiles had been depleted and so Senator Harry Reid introduced bill S. 2594, which authorized the Secretary of Treasury to purchase silver on the open market once the silver stockpile was depleted. To this day, the American Silver Eagle coin is still minted and the investment demand for it grows every year.

American Silver Eagle Investment Purposes

The Silver Eagle coin can be a great coin to add to your investment portfolio, but it is important to note that it is not necessarily the best option for all investment goals. Lone Star Bullion is one of the most competitive silver eagle distributors in Houston, San Antonio, and across the nation. At Lone Star Bullion, we take a goals based approach to helping our Houston, San Antonio, and National clients determine whether or not silver eagles best fit their investment needs.

A great example of a time when it would not be a good idea to invest in silver eagles versus another form of silver bullion was back in the spring of 2010. Silver was at nearly $50 an ounce. Silver Eagle premiums were between $4-$5 with competitive dealers like ourselves and $6-$7 with local coins shops and dealers. Additionally silver bars and coins were only seeing premiums of $1.29-$2.00 over the spot price of silver. For an individual whose goal is to invest in physical silver for the short-term,(6 months-2 years) we were not recommending they buy silver eagles because of the massive premium difference between the two. At Lone Star Bullion we operate by a principle call the “Real Cost Principle.” We believe that investors should not only examine the cost of buying the physical silver, but also the buy back price they could potentially receive. At this particular time, our company was buying silver Eagles back at $2-$2.50 over spot and were buying back rounds and bars at spot to $.50 over spot. When we examine the real cost of the silver eagles versus the round or bars, we find that the bars or rounds were $1.50 cheaper, or nearly 3%.

On the other hand, there are other times like now when there is only a $.20-$.30 difference in the real cost of silver eagles and silver bars and rounds. In this case, our recommendation is to purchase the silver eagle. First, we recommend it because of the 1099 reporting exemption. Second, as the price of silver increases, the silver eagle has a historical track record of trading at a relatively consistent premium of 9-10% of the silver spot price. This means you potentially have an opportunity to make money on both the silver price appreciation and the premium increase on the silver coin. The final reason we would recommend going with the silver eagle in this case is the potential of the US Silver to Eagle to become a numismatic coin. Since it inception in 1986, there have been several times in which the silver eagle was nearly not minted. If the mint ever decided to stop producing the coins, investor would also have a numismatic coin on their hands.

How to Invest in Silver Eagles in Houston and San Antonio

Silver Eagles come in 20oz tubes or 500oz boxes called a “monster box.” At Lone Star Bullion we have a $1,000 minimum on silver so its important that your purchase at least be 50oz or more at a time. The reason for this minimum is that in the state of Texas if an individual purchases more than $1,000 of silver they do not have to pay sales tax so it is important to stay above that number. In effect you as an investor save $82.50 every time you buy over $1,000. Purchasing larger quantities enable you as the investor to get the largest discount on your investment. So if possible purchase 500oz or more at a time.

The World Reserve Currency and the Iranian Sanctions

Many Americans think the United States in invincible and regardless of how much money we spend, borrow, and print that there won’t be any drastic consequences. It’s as if they believe there is a magical power that protects the United States. As a matter of fact there is a name for this magical power of protection and it is called the world reserve currency.

History of the World Reserve Currency

After World War II, the United States dollar became the world’s reserve currency. Before this Britain with the pound sterling held the position as the world reserve currency for nearly all of the 19th century. Great Britain was the leading exporter of manufactured goods and services and the largest importer of food and industrial raw materials during this period. Between the early 1860s and the outbreak of World War I in 1914, some 60 percent of all the world’s trade was invoiced in British pounds sterling. As U.K. banks expanded their overseas business, propelled by innovations in communications technology such as the telegraph, the British Pound was increasingly used as a currency of denomination for commercial transactions between non-U.K. residents—that is, the pound sterling became a more international currency. This role for the pound was further enhanced by London’s emergence as the world’s leading shipper and insurer of traded goods and as a center for the organized commodities markets, as well as by the growing amount of British foreign investment, of which a large share was in the form of long-term securities denominated in pounds sterling. It was at the turn of 20th century that British influence began to deteriorate. Slowly the French Franc and German Mark began to be used as a reserve. However, the critical blow to Britain’s status as the world reserve currency occurred after World War II. Britain was devastated. They had taken out so many loans in order to finance their operations during the war that they were in horrible financial shape. It was at this point that the Bretton Woods agreement was formed and the US dollar, backed by gold, was used as the world reserve currency. The only major event that has taken place since then has been the dollar leaving the gold standard. So effectively now we have the dollar alone as the world reserve currency.

The Impact of the World Reserve Currency

What does the world reserve currency status effectively do for a country? It is interesting to look at the chart below. Every major country that has ever held the world’s reserve currency status has been a major player in world trade.

Effectively when a currency becomes the world reserve currency it means that most of the world uses that currency as the method of transaction between countries. As an example, if China wants to trade with Australia, today they will use the dollar instead if either the Chinese or Australian currency. The argument is that it is a fair way to use a good currency and a single currency in all international transactions. Consequentially, the world reserve currency, in this case the dollar, has a demand far beyond its own country and domestic use. It is used in both international trade and also held as a reserve by foreign countries. Today, China alone holds nearly $3 trillion dollars as a currency reserve.

The United States status as the world reserve currency has effectively allowed the manipulation of our currency and inflation to occur far beyond the normal and natural limits. It is interesting that Greece started to see their cost of debt rise once they crossed over the 100% debt to GDP mark. However, in the United States, we have seen no such problems as of yet. Effectively, the United States reserve currency status has given it an ace of spades so to speak when it comes to financial hardship.

The US Lose the World Reserve Currency?

It is important to realize that there is a dark cloud on the horizon for the United States. Every year there is a meeting of the top 20 economic super powers called the G-20 Summit. Over the last several years, multiple countries have suggested that the dollar no longer be used as the world reserve currency. Each year this party gains more and more traction. When the dollar loses its place as the world reserve currency, the dollar will plummet in value. Countries like China, Japan, and India who hold large amounts of dollars as reserves will dump them as fast as they can in order to either get the new world reserve currency or purchase hard assets like gold. In this event, Americans who hold most of their wealth in dollars or dollar denominated assets will get hit the hardest.

Iranian Sanction and the World Reserve Currency

So how is Iran significant? With both the United States and the EU putting sanctions on Iran and its central bank, Iran is caught between a rock and a hard place. Iran sells a massive amount of oil to India, China, and Japan. India and China together account for over 34 percent of Iran’s oil exports — slightly more than Europe, according to International Energy Agency data. India has defied the sanctions and has continued to purchase oil with gold instead of dollars. Therefore India has technically avoided violating the sanctions. This means billions of dollars in oil will no longer be purchased in dollars, but will purchased using gold or another currency. This is the first effective challenge to the United States as the world reserve currency. As the crisis develops it will be very important to watch how many countries continue to purchase oil from Iran in spite of the sanctions. It will also be interesting to see whether the United States goes to war with Iran. Every nation that has begun to not accept dollars for oil in the past have eventually been taken out.(Iraq and Libya)

Houston Gold Exchange

Many precious metals investors in Houston are not sure whether they should own a higher percentage of gold or silver or whether they should do a Houston gold exchange. Is gold or silver a better investment?

Houston Gold Exchange Great Idea

What most investors don’t know is that silver is by far a better investment than gold. Over the past ten years silver has outperformed gold handily. Additionally, silver is used in a vast quantity of industrial functions and its industrial demand has increased every year for over a decade. As if this is not enough, the historical gold to silver ratio has departed from its historic world history average of 12 to 1 and the US average of 16 to 1 and currently stands at 55 to 1. Finally, there is a massive above ground shortage of silver that will take years to remedy. The situation is so bad right now that there are 3 ounces of aboveground gold for every 1 ounce of aboveground silver. So clearly silver is the better investment, but should investors make a gold exchange in Houston?

Houston Gold Exchange Timing

Should investors exchange their gold for silver in Houston? If so, is there a better time to do it then others? The answer is yes. It is definitely a good idea for investor to exchange their gold for silver. Silver will most definitely outperform gold over the next 5 to 10 years and so transferring current investments in physical gold into physical silver is a very smart investment move. However, there are better times than others to exchange gold into silver. A great time for doing this was right after silver nearly reached $50 an ounce early in 2011. Silver fell over 30% to less than $33 an ounce. At the same time, gold fell from $1550 to $1475 or only 5%. In this case if an investor had traded gold into silver before the correction, they would have received approximately 32 ounces of silver for every 1oz of silver. However, if an investor waited until after the correction, they would have received approximately 45 ounces of silver for every 1oz of gold! This makes a huge difference in your return over the long-term.

Houston Gold Exchange Process

How easy is it to make a Houston gold exchange? The process is overall very simple. At Lone Star Bullion, we determine the value of your gold bullion and simply credit it toward your silver exchange. Some investors are concerned that they will lose money on the transaction based on commissions charged. However, this simply isn’t true. The commissions charged by Lone Star Bullion are very competitive and would be no different than if a person was considering a normal silver bullion purchase. In the end, making a gold and silver exchange in Houston is arguably the smartest investment move they can make in the current markets.

← Older posts Newer posts →