BLOG

Ron Paul’s Incredible Speech After Taking 2nd Place in New Hampshire

This is truly a historic moment for the liberty movement and for sound economic policy. Ron Paul perhaps the only candidate who has run in the past several decades who truly desires to deal with our country’s dire economic condition. He came in with a decisive 2nd place victory in New Hampshire and gave an incredible speech on the importance of liberty, monetary soundness, and ultimately what it will take for the United States to get back on track.

Should I Buy Gold and Silver From a Houston Coin Shop?

To answer this question, an investor must ask, “What benefits do I receive when doing business with a coin shop?” The biggest benefit to doing business with a coin shop is going to a physical location, looking at the merchandise before purchasing, and talking to a sales associate in person. Of these advantages, only one results in any kind of savings. When an investor can purchase gold and silver locally they are able to save money on shipping and insurance charges typically charged by online companies.

Uncompetitive Pricing

Unfortunately, while there are a few advantages of buying from a coin shop in Houston there are far more disadvantages. First, coin shops by their very nature have large overhead. They have rent to pay, employees to pay, insurance to purchase, and the list goes on and on. As a result, coin shops in Houston are notorious for being extremely uncompetitive in their pricing. As an example, most coin shops in Houston currently sell American Silver Eagles for $3.50-$5.50 over spot, while Lone Star Bullion is selling them for $2.99-$3.49 over spot. On average, coin shops charge anywhere from 2-7% more for most of their gold and silver coins, bars, and other products. This is also true when they buy back from the public. Take the silver eagle as an example again. Most coin shops are currently buying silver eagles back from the public for spot to $.50 over spot in comparison to Lone Star Bullion which is buying them back for $1.25-$1.50, a difference of 2-3%!

Disregard for Privacy

Second, most coin shops in Houston require investors to show their drivers license and give additional private information beyond what the law requires. Often times they will record drivers license numbers and other personal information in connection with the transaction. When buying gold and silver in Houston, privacy has to be one of an investor’s top concerns.

Bad Recommendations

Third, most Houston coin shops simply seek to sell investors those products, which bring them the most commission. I have talked to countless investors who have purchased fractional gold and other products that were obviously sold purely because the commission is three to five times higher than any other gold or silver product.

No Expertise

Fourth, most Houston coin shops have absolutely no expertise when it come to economics, finance, or precious metals. Most coin shops simply can tell you prices and options, but not give you any strategic advice when it comes to determining whether you should buy gold or silver, what type of gold or silver to purchase, and how much you should buy. To most coin shops they view each client as a transaction, not as an investor who has specific goals they are trying to accomplish.

I have personally bought from, got quotes from or been to each of the major Houston coins shops and can say from personal experience that they do not have competitive prices, good customer service, appreciation of customer privacy, or a good understanding of economics or finance.

David Morgan: Predictions for 2012

David Morgan shares his predictions for 2012 for gold and silver. In this interview with Ellis Martin, The Silver Guru, David Morgan predicts $60 silver for 2012 with an optimistic view of the year in general. He repeats his suggestion to accumulate physical silver.

Greece Threatens to Withdraw from European Union and Euro!

Greece is now threatening to withdraw from the EU and Euro if they do not receive another bailout. They also are insisting than any austerity requirements be dropped in connection to receiving the funds. If this occurs it will be devastating for Europe and every holder of Greek debt. The impact of such on the precious metals asset class cannot be underestimated. Tune in this Friday for the Strategic Silver Investor Weekly Report where we will talk about this very issue.

Peter Schiff’s Gold and Silver Predictions for 2012

Peter Schiff talks about where he sees silver and gold heading in 2012 and how the recent correction only makes his outlook on both gold and silver even more bullish. He talks about the importance of silver and gold investors who are on the fence making a decision to get while they can still take advantage of the low prices.

How is the Silver Price Determined?

Many silver investors ask, “How is the silver price determined?” It is question that is so important to gold and silver investors and yet can be very difficult to understand. Silver is traded around the clock and around world in the commodity markets of New York, Chicago, London, Zurich, Paris, Hong Kong, Shanghai, and Sydney. The trading of silver goes back to the 17th century with the London markets and to this day London remains the center of the physical silver trade for most of the world.

COMEX

However, it is important to note that the COMEX division of the New York Mercantile Exchange is the most important paper contracts trading market for silver. The silver price or silver spot price is determined by the COMEX. While the buying and selling of physical silver affect the silver price, paper silver is by far the biggest market force driving the silver price higher or lower. It is estimated by economists and precious metals experts that the ratio of paper silver contracts to physical metals is between 100 and 200 to 1. Some experts go as far as to say that the ratio could be as high as 500 to 1.

Why is this significant? A common misconception amongst investors is that when the silver and gold price falls there is a larger amount of physical metal on the market, but this simply isn’t true. It is extremely likely in the current environment to see the price of silver and gold fall and not be able to get a hold of physical silver. A great example of this was back in 2008. During this time silver fell to $9 an ounce and so many investors wanted to get in, but very few investors could buy the physical metal. Why? Because while paper silver was being sold investors holding physical metal were hording and were only buying more.

Exchange Manipulation

What silver investors need to realize is that the exchanges themselves are a manipulation of the silver prices. As a silver investor myself, I view this as a positive thing, because it allows me to purchase physical silver at prices I would never be able to access if the market was based solely on the physical supply. Having said this, silver investors must also realize that at some point there will be a run on the exchanges. Any investor holding a paper silver contract can request delivery. The problem is that currently on average only 1% of all paper contracts actually request physical delivery. The COMEX division does not have nearly enough metal to meet the demand that would arise if a run on the exchanges occurred. The inevitable result would be silver prices shooting through the roof as the available above ground stock of silver would be completely exhausted within a very short period of time.

Gold and Silver Investor: Deflation or Inflation?

What country had 12,950,000,000,000,000% inflation during a single month and during what time frame? For most of us it seems nearly impossible that a country could have such rapid inflation in one year let alone in a single month, but nonetheless 12,950,000,000,000,000% inflation was recorded in Hungary in 1945 and 1946 right after the Great World War. In fact, if you look at the list of countries that have had hyperinflation, a majority of them are from the 20th century.

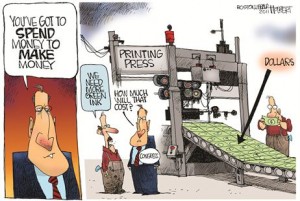

Today, most Americans say we are clearly having inflation, while many economist claim we are in a deflationary cycle. In addition to this the government and Federal Reserve have continued to say that deflation is one of the worst things that can occur, while consumers say inflation is the worst possible option. So the question is who is right?

What is Inflation?

As gold and silver investors, to truly understand this we must understand first that inflation is simply prices increasing and deflation is prices falling. It does not get more simple than that. Consumers point to rising gas prices, food, energy, gold, silver, and basic necessities to make their case while economists point to the housing market and other large ticket items to make their case. The answer is that they both are right. We are seeing inflation in commodities like gold and silver, but not in housing, wages, and other large ticket items.

Ways to Combat Inflation

However, what is even more important to understand is that inflation and deflation are inexplicably linked. Right now the United States nearly has a $15 trillion debt and is running close to a 14% deficit. If a country has no intention of paying of its debt there is only three responses: (1) default; (2) inflation; and (3) restructure their debt. The historical option most countries have taken is number (2). If countries can simply print a large enough amount of money they can debase their currency to the point that their debt is extremely easy to pay of. As an example lets says Mexico owes the United States one million pesos and their current money supply is ten million pesos, this means their debt is 10% of their money supply. In order for Mexico to decrease its debt all they have to do is print an additional ninety million pesos in order to reduce their debt percentage from 10% to 1%. This is why inflation is the number one choice for most governments. It is the stealthiest way they can tax the population or government debt holders without “technically” taking anything from them.

So why do governments fear deflation so much? The answer is very simple. If all a government has to do is inflate their currency in order to reduce the size of their debt then logically if a currency strengthens it increases the size of the debt. Also when deflation occurs, tax revenues also fall. So for countries that have no debt deflation or currency appreciation are a very small problem in comparison to a country that has a rising debt.

In history, it seems that in a majority of cases hyperinflation always seems to follow deflation, because of a government’s eagerness to reduce its debt load or temporarily speed up the economy. However, they find that each dose of money supply only last so long and each additional supply last a shorter, shorter, and shorter length of time. Inevitably countries face similar situations to Hungary and have to print outrageously large amounts of money to have any effect at all.

So currently I believe we are in a mixed inflationary and deflationary cycle in which some resources are seeing price depreciation, while others are seeing price appreciation. Most of the price deflation is occurring in areas where a bubble has recently popped such as the housing market. However, our government has already set a precedent of Quantitative Easing for inflationary measures during what they perceive to be a deflationary cycle. The road once taken is hard to leave.

Josh Renfro

President & Founder

Lone Star Bullion LLC

Will the Government Confiscate Gold?

Roosevelt Gold Confiscation: Executive Order 6102

This is a one of the top questions asked by gold and silver investors. This question is largely asked because of what gold and silver investor have heard concerning Franklin D. Roosevelt’s Executive Order in 1933. So the first thing we have to do is examine the reasons behind this confiscation. Executive Order No. 6102 issued by Franklin Delano Roosevelt outlawed the ownership of gold. The government bought back gold at $20.67 an ounce from the public in accordance with eminent domain law. There are a couple of important things to note about the confiscation. First, almost all the gold that was confiscated was voluntarily given up. All other gold that was confiscated was held at banks or by very large investors. So even this confiscation was not comprehensive or effective.

However for us to truly answer this question we have to ask , “Why would a government choose to confiscate gold?” There are two main reasons. The first reason a government would confiscate gold is in order to gain additional funds in order to deal with fiscally hardship. And the second reason would be in order to inflate the money supply.

The Real Reason for Gold Confiscation

Most gold and silver investors believe confiscation is likely because they only are considering the first option. Most investors in gold and silver believe that is why Roosevelt confiscated gold. However, this simply isn’t true. In 1933, the United States was on the gold standard, which meant that every dollar in circulation was backed by physical gold. This meant that FDR could not simply print money in order to finance his massive spending and this is why FDR ended up confiscating gold. He could not inflate the dollar until he controlled the value of the gold. It is important to note here that the US government held 68.2% of the world’s supply of gold at the time. Once Roosevelt made gold ownership illegal, he immediately raised the price of gold to $35 an ounce. This immediately devalued the dollar by 40% over night. This is truly the reason why Franklin Delano Roosevelt confiscated gold. Therefore FDR would not confiscate gold today because the Fed now has the ability to inflate the money supply without controlling the gold supply.

Gold or Retirement Account Confiscation?

The real question when it comes to confiscation is would the US government confiscate gold because they were in a fiscal straight. I think the answer is no. Gold holdings are very small in the US. At most we are talking about several billion dollars. If the government was truly in need of funds there would be several larger and more obvious targets. The first and most obvious one is retirement accounts. According to the Investment Company Institute there was $7.835 trillion in IRA, 401K, 457, and 403b accounts in 2009. All gold and silver holdings in the United States are a miniscule fraction of this huge source of wealth. There is also historical precedent for government confiscation of retirement accounts especially in socialistic and communistic countries. Even if the government attempted to confiscate gold, the task would be enormous. The logistics of attempting a house to house search for gold and silver would be massive and would hardly be worth the man power and money that would have to be used in order to confiscate it. In the end, the chance of the government confiscating gold and silver seems extremely small.

Josh Renfr0

President & Founder

Lone Star Bullion

Kyle Bass: Comex Can’t Deliver Physical Gold and Silver!

Kyle Bass discusses how the Comex exchange can’t physically deliver on the gold and silver contracts it issues. This is extremely significant because it will force the price of gold and silver through the roof. Check out the video as he explains this in detail.

Global Bullion Exchange Scam

With gold and silver prices continuing to rise, scammers are coming out of the woodwork. The scam that occurred with the Global Bullion Exchange is a classic example of what happens when investors choose not to invest in physical gold and silver and then physically hold it themselves. This video details how the scammers conducted their business and things to watch out for.

← Older posts Newer posts →