BLOG

Gold and Silver Investor: Deflation or Inflation?

What country had 12,950,000,000,000,000% inflation during a single month and during what time frame? For most of us it seems nearly impossible that a country could have such rapid inflation in one year let alone in a single month, but nonetheless 12,950,000,000,000,000% inflation was recorded in Hungary in 1945 and 1946 right after the Great World War. In fact, if you look at the list of countries that have had hyperinflation, a majority of them are from the 20th century.

Today, most Americans say we are clearly having inflation, while many economist claim we are in a deflationary cycle. In addition to this the government and Federal Reserve have continued to say that deflation is one of the worst things that can occur, while consumers say inflation is the worst possible option. So the question is who is right?

What is Inflation?

As gold and silver investors, to truly understand this we must understand first that inflation is simply prices increasing and deflation is prices falling. It does not get more simple than that. Consumers point to rising gas prices, food, energy, gold, silver, and basic necessities to make their case while economists point to the housing market and other large ticket items to make their case. The answer is that they both are right. We are seeing inflation in commodities like gold and silver, but not in housing, wages, and other large ticket items.

Ways to Combat Inflation

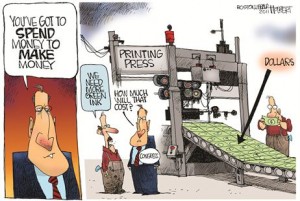

However, what is even more important to understand is that inflation and deflation are inexplicably linked. Right now the United States nearly has a $15 trillion debt and is running close to a 14% deficit. If a country has no intention of paying of its debt there is only three responses: (1) default; (2) inflation; and (3) restructure their debt. The historical option most countries have taken is number (2). If countries can simply print a large enough amount of money they can debase their currency to the point that their debt is extremely easy to pay of. As an example lets says Mexico owes the United States one million pesos and their current money supply is ten million pesos, this means their debt is 10% of their money supply. In order for Mexico to decrease its debt all they have to do is print an additional ninety million pesos in order to reduce their debt percentage from 10% to 1%. This is why inflation is the number one choice for most governments. It is the stealthiest way they can tax the population or government debt holders without “technically” taking anything from them.

So why do governments fear deflation so much? The answer is very simple. If all a government has to do is inflate their currency in order to reduce the size of their debt then logically if a currency strengthens it increases the size of the debt. Also when deflation occurs, tax revenues also fall. So for countries that have no debt deflation or currency appreciation are a very small problem in comparison to a country that has a rising debt.

In history, it seems that in a majority of cases hyperinflation always seems to follow deflation, because of a government’s eagerness to reduce its debt load or temporarily speed up the economy. However, they find that each dose of money supply only last so long and each additional supply last a shorter, shorter, and shorter length of time. Inevitably countries face similar situations to Hungary and have to print outrageously large amounts of money to have any effect at all.

So currently I believe we are in a mixed inflationary and deflationary cycle in which some resources are seeing price depreciation, while others are seeing price appreciation. Most of the price deflation is occurring in areas where a bubble has recently popped such as the housing market. However, our government has already set a precedent of Quantitative Easing for inflationary measures during what they perceive to be a deflationary cycle. The road once taken is hard to leave.

Josh Renfro

President & Founder

Lone Star Bullion LLC